In Washington, DC, Medicare Supplement plans function as a secondary source of coverage to Original Medicare. These plans defray costs that would otherwise be the beneficiary’s responsibility. In Washington, DC, the Medicare Supplement plans are consistent with those offered in other states.

One of the key benefits of a Medicare Supplement plan is that it can be used across the United States without needing a specific network of physicians or referrals. Although there may be slight variations in the cost and other factors depending on the carrier and location, all Medicare Supplement plans to comply with standardized health benefit regulations established by the federal government.

Thus, regardless of where one resides or which carrier is selected, the benefits of a Medicare Supplement plan remain consistently and reliably the same.

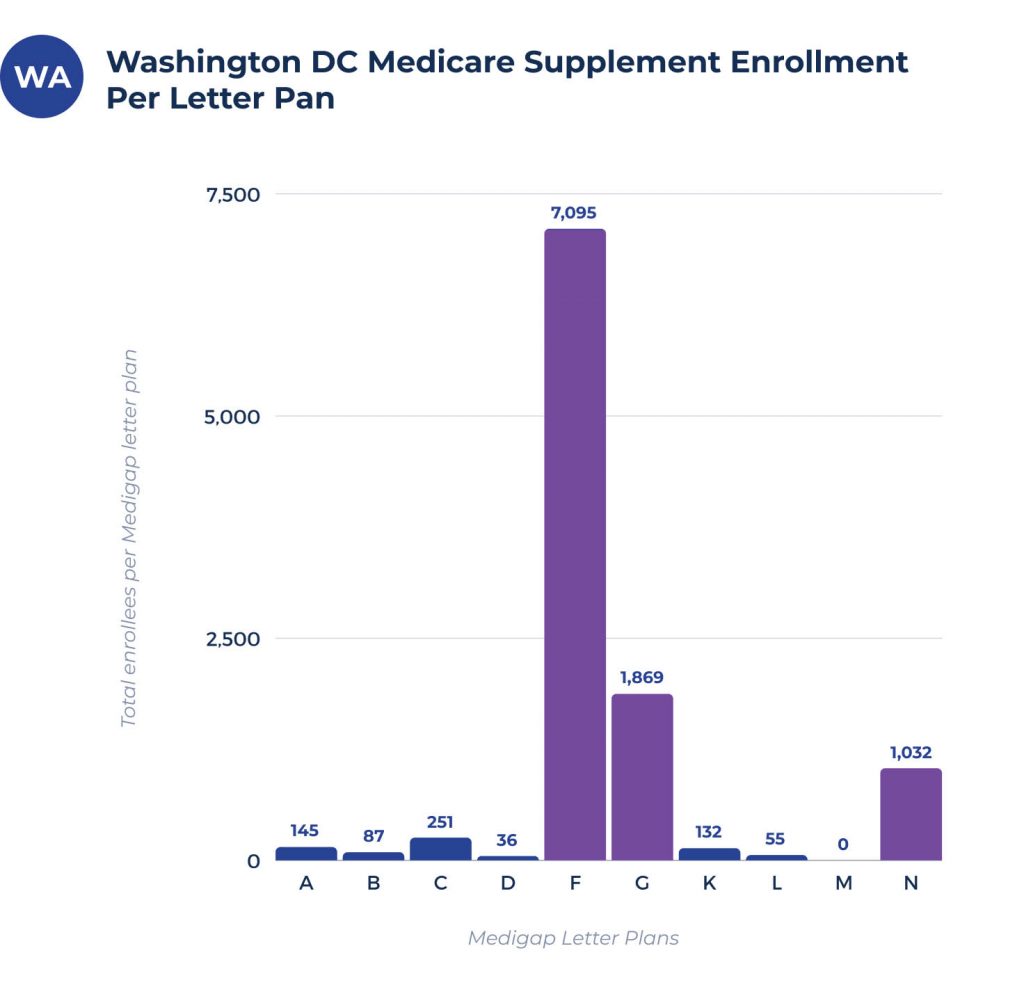

Washington DC Medicare Supplement enrollment per letter plan

Washington, DC, presents various Medicare Supplement plans to eligible beneficiaries. However, not all plans may be accessible to each individual. Washington, DC, offers twelve Medicare Supplement plans comprising ten alphabetically designated programs, A through N, and two high-deductible plans.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| DC | 145 | 87 | 251 | 36 | 7,095 | 1,869 | 132 | 55 | 0 | 1,032 |

Best Medigap plans in Washington DC

Three of these plans provide comprehensive coverage for Medicare beneficiaries:

Choosing the ideal plan from among these top three options is contingent upon the specific benefits that a beneficiary requires. Each program presents a distinct level of coverage. These three plans may be the most appropriate option depending on an individual’s healthcare needs.

Medigap plan coverage chart for Washington DC

The following chart shows the coverage benefits of each letter plan within the Medigap program. These benefits are standardized across all carriers, ensuring consistency and predictability in coverage for beneficiaries.

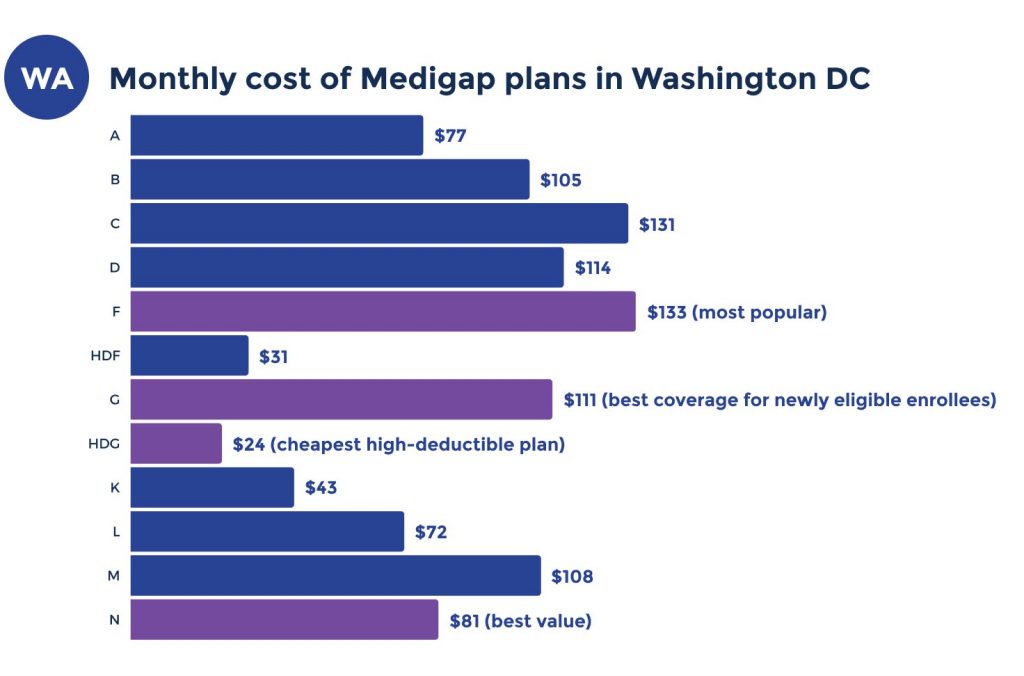

Medicare Supplement plan costs in Washington DC

Various factors influence the premium of your Medigap plan in Washington, DC. The most prevalent factors impacting your personalized rate include age, geographical location, gender, tobacco usage, household discounts, enrollment period, and payment method.

For your convenience, we have provided detailed charts showcasing the minimum and maximum premium for each lettered Medigap plan in the District of Columbia.

How much does Medigap Plans cost in Washington DC

The premium for a Medigap plan in Washington, DC, is subject to variation, with a range of $70 to $200 per month anticipated for individuals seeking such coverage.

Lowest premium per Medigap plan in Washington DC

The Medicare Supplement chart below provides the lowest premium for each lettered plan. The accompanying chart outlines the premiums for a 65-year-old female.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $77 | $105 | $131 | $145 | $133 | $110 | $43 | $71 | $179 | $81 |

Most expensive premium per Medigap letter plan in Washington DC

When considering the costs associated with each Medigap plan, it is essential to note that higher premiums often correlate with a specific plan letter. For a 65-year-old female, the following chart displays the plans with the highest premiums.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $231 | $259 | $324 | $210 | $313 | $192 | $129 | $179 | $360 | $166 |

Top Medicare Supplement plan carriers in Washington DC

Below are some leading Medigap plan providers operating in Washington, DC. The accompanying chart displays rates for a 65-year-old female. Irrespective of the carrier selected, the benefits remain unchanged.

Hence, picking the lowest premium option for the chosen letter plan would be the most reasonable choice. For instance, for Plan N, enrolling with Aetna would be the most economical option. The same holds true for Plan F and Plan G.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| $132 | $110 | $88 | |

| Aetna | $145 | $129 | $81 |

| Globe Life | $173 | $152 | $107 |

| Allstate | $174 | $133 | $104 |

| Mutual Of Omaha | $186 | $111 | $95 |

FAQs

Which Medicare Supplement plan pays everything in Washington DC?

Medicare Supplement Plan F covers all cost-share left over from Original Medicare. Medicare beneficiaries eligible before January 1, 2020, can still enroll in Medigap plan F. The most comprehensive plan for new Medicare members is Plan G.

What’s the downside to Medigap plans?

Medicare Supplement plans provide the most comprehensive coverage and the least restrictions. However, you must still pay your Medicare Part B and Medigap premiums.

In addition, they don’t cover prescription drugs from the pharmacy, so you will need an additional Part D plan. These added costs make Medicare Supplement plans more expensive than the Medicare Advantage program.

What’s the least expensive Medigap plan in Washington, DC?

The high-deductible Plan G is the least expensive Medigap plan in Washington, DC. The premium begins at $24 monthly.

Does Washington DC Medigap plans to get more expensive as you age?

Most Medicare Supplement insurance carriers in Washington, DC, offer attained age plans. This means the plans increase as you age. Remember that most will increase annually regardless of your plan’s age rating.

How to sign up for Medicare Supplement plans in Washington DC

Should you require assistance enrolling in a Medigap plan in Washington, DC, please do not hesitate to contact us. Our team has extensive knowledge and experience working with all the leading carriers within the state. They will meticulously compare each letter plan with each carrier to ensure you receive the most competitive premium.

Don’t hesitate to contact us via the number provided above. Alternatively, you may begin the process by filling out our online rate form. We are committed to providing you with the highest level of professional service.

Related Articles

- What are the Top 5 Medicare Supplement Plans

- Top 10 Medicare Supplement Companies

- When Can I Change My Medicare Supplement Plan?

- Do I Really Need Supplemental Insurance With Medicare?

- Medigap Plan F vs. Plan G vs. Plan N