There are several choices with Medicare. A Medicare Advantage (Part C) plan is one of your options. A Medicare Advantage plan is another way to receive your Medicare benefits.

Medicare Advantage plans (Medicare Part C): What are they, and how do they work?

They must include all the benefits of Original Medicare. They usually have additional benefits not offered by Original Medicare. Medicare Advantage is an all-in-one plan that comes in several different varieties. When you enroll in a Part C plan, they are now in charge of your health coverage instead of Original Medicare.

Over-the-counter drug benefits, gym memberships, dental, vision, hearing, and healthy food allowances are additional benefits you can have with a MA plan. Most versions include prescription drug coverage called MAPDs.

These plans will have a Maximum-Out-Of-Pocket that limits how much you will pay for approved medical services. These begin on January 1 and run for the calendar year. Changing plans can only occur at certain times of the year or enrollment periods.

Medicare Advantage plans work like most of your typical group plans. A Part C plan is not the same as a Medicare Supplement plan.

Who’s eligible for a Medicare Advantage plan?

Anyone enrolled in Medicare Part A and Part B and who lives in the service area can enroll. Part C plans aren’t available in all areas.

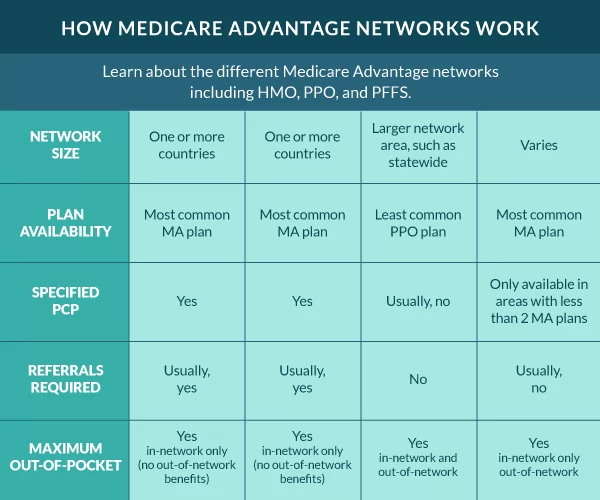

What types of Medicare Advantage plans Are There?

Medicare Advantage plans come in several options, aren’t available in every area, and all options excel in different benefits. The plan you select determines the costs and coverage.

Health Maintenance Organizations (HMO)

An HMO plan is a network-based plan. These plans typically have the most robust coverage, lower copays, and out-of-pocket costs. They require you to see your primary care physician for a referral before going for other services.

HMOs focus on preventative care and wellness. The entire model revolves around keeping you healthy. The healthier you’re, the lower your medical costs for you and the plan. The only services you can receive out of network are emergency or dialysis services.

The HMO typically has the lowest Maximum-Out-Of-Pocket (MOOP) of all the MA options and typically has the most additional benefits not covered by Original Medicare.

Health Maintenance Organizations – Point Of Service (HMO-POS)

An HMO-POS is an HMO that allows some services out of the network. To determine which out-of-network services are allowed, refer to the summary of benefits.

Preferred Provider Organizations (PPO)

PPO plans have a preferred provider network but allow coverage out of the network. Your services will cost less if you use in-network providers.

In most cases, PPO plans don’t require a referral to see a specialist. You can visit any provider that accepts Original Medicare. Be aware that there could be higher costs.

The MOOP on a PPO will be higher than most other options. You will notice the PPO has two MOOPs. One covers in-network services and another for out-of-network services.

PPO options work well for beneficiaries that like to travel for extended periods. You have more freedom of what doctors and hospitals you can use. The copays and out-of-pocket costs are usually more than that of an HMO.

Private Fee For Service (PFFS)

PFFS plans are unique and are more common in rural areas. PFFS plans allow you to see any doctor that accepts Original Medicare. When you see a provider using a PFFS plan, the provider must agree to the terms before each visit.

Medicare Savings Account (MSA)

MSAs are unique options in the Medicare Advantage world. Most don’t have networks. These plans are similar to the HSA plans outside of Medicare. MSA plans consist of 2 parts.

The first part is a high-deductible Medicare Part C plan that begins coverage after reaching the plan deductible. The plan deductible varies.

The second part is a type of savings account with monthly deposits for healthcare costs. You might also receive a debit card known as a flex card. The amount deposited varied from state to state. The funds pay for healthcare costs until you reach the deductible.

Special Needs Plan (SNP)

Plans are available for beneficiaries with special needs. There are three categories for SNP plans dual, chronic, and institutionalized.

FAQs

Are there still Medicare Advantage MSA plans available?

Medicare Advantage MSA programs are rare. They are only available in a few areas nationwide. Minnesota still offers MSA plans in some areas.

Are Medicare Advantage Plans Bad?

No, the best Medicare Advantage plans aren’t bad. They are just not the best choice for everyone. There are good and bad things to consider when enrolling in a Medicare Advantage plan.

What is the downside to Medicare Advantage plans?

The downside to Medicare Advantage plans is the limitations and out-of-pocket costs. These plans come with limited doctor networks, limited benefits, and many forms of cost-sharing.

Why do doctors not like Medicare Advantage plans?

Some doctors feel that Medicare Advantage plans don’t make it easy to get paid for their services like Original Medicare. That’s why a lot of doctors don’t accept Part C.

Why is Medicare Advantage being pushed so hard?

We’ve seen a significant push on Medicare Advantage plans lately because of how they’re funded. The federal government pays the Medicare Advantage carrier monthly to cover your healthcare costs. Essentially, taking on your risk.

Are Medicare Advantage plans too good to be true?

Yes and no, it depends on each beneficiary’s specific situation. For those on a limited income who can’t afford a Medigap plan, a Medicare Advantage plan is better than no supplemental plan. However, don’t be fooled by the zero-dollar premium. You will have much higher out-of-pocket costs when using the benefits than with a Medigap plan.

Does getting a Medicare Advantage plan make you lose your Original Medicare?

Technically, yes. When you enroll in a Medicare Part C plan, you leave your Original Medicare.

How to enroll in a Medicare Advantage plan

Whether you’re new to Medicare or looking to change your current plan, we’re here to help. Your agents are licensed in all states and work with all major carriers. We can compare Medicare Advantage plans side by side to make sure you get the best coverage available at the lowest cost. Give us a call, or complete our rate form to get rates now.

Related Content

- Medicare Advantage HMO Plans

- Medicare Advantage PPO Plans

- Medicare Advantage HMO-POS

- Medicare Advantage Private Fee-for-Service Plans (PFFS)

- Medicare Advantage Prescription Drug Plan (MAPD)

- Medicare Advantage Special Needs Plans (SNP)

- Difference in Medicare Advantage HMO vs PPO

- Medigap vs Medicare Advantage Comparison