New Mexico Medicare Supplement plans are standardized health insurance plans that help you save more by covering costs like inpatient nursing home visits and outpatient services.

Medigap’s benefits are the same between carriers and states, but costs change depending on many factors.

New Mexico Medicare Supplement coverage chart per letter plan

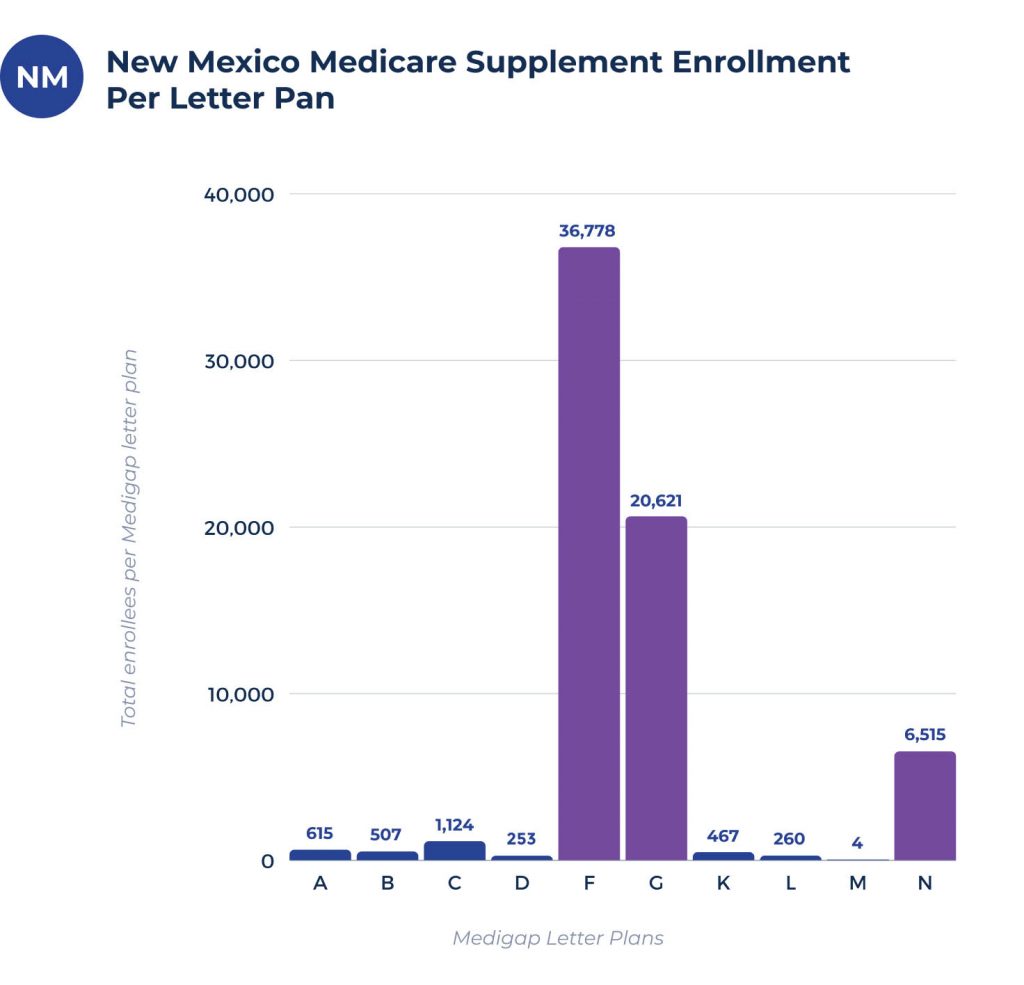

There are 67,447 lives that Medigap covers in New Mexico. Of these covered lives, 23.1% of these people have a Fee-for-Service plan from Medicare.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 790 | 627 | 1,472 | 219 | 40,696 | 12,635 | 468 | 258 | 5 | 6,061 |

What are the best Medigap plans in New Mexico?

Among the leading New Mexico Medicare Supplement plans, Plan F, Plan G, and Plan N are the best known. These plans have the most enrollees.

Medigap Plan F is a highly in-demand policy. It features 40,696 enrollees.

The next most popular option is Medigap Plan G. Its near-full coverage benefits garner 12,635 individual sign-ups.

Medigap Plan N offers excellent coverage as well. Around 6,061 people choose this plan for its performance and cost benefits.

Medigap Plan C is another option with significant enrollee numbers compared to the state’s other plans. With 1,472 enrollees, the plan covers everything except Part B excess charges, making it a suitable option for many.

Medigap plan coverage chart for New Mexico

The benefits in the below chart remain the same no matter the state. You’ll find the same benefits in New Mexico as in New York. Many plans offer identical coverage inclusions, so properly distinguishing them from one another is essential to avoid problems.

Medicare Supplement plans costs in New Mexico

Multiple factors impact your New Mexico Medicare Supplement plan’s cost, from location to age or gender.

In other cases, using tobacco, whether you’ve had rate locks or increases, and your payment method can also affect the policy’s cost. Your enrollment date and existing household discounts are also determining factors.

What’s the average cost for a Medicare Supplement plan in New Mexico?

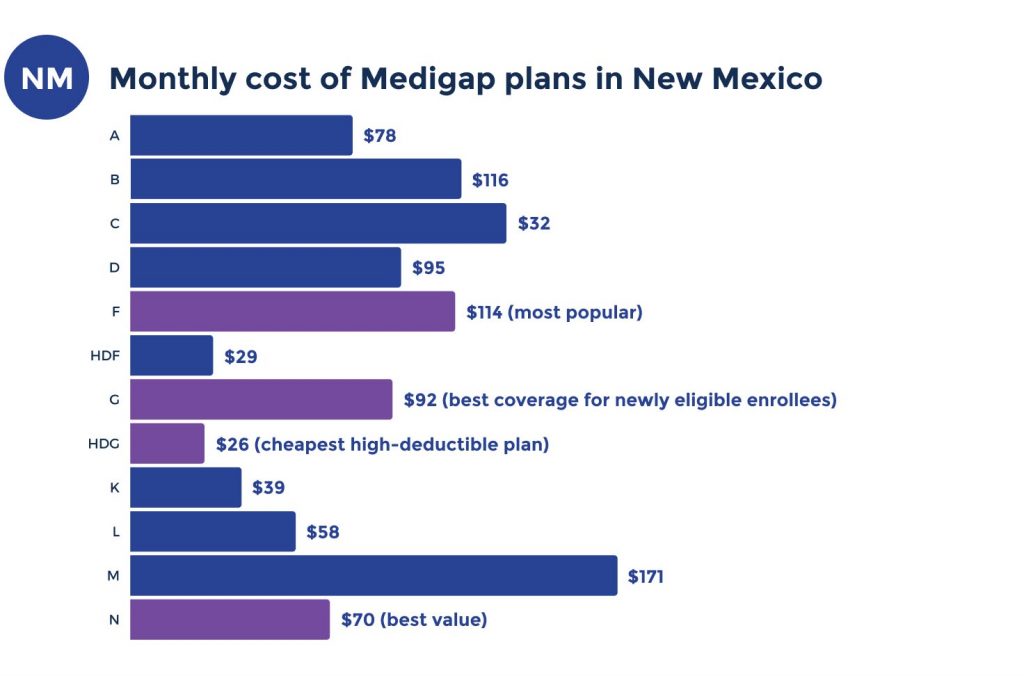

The cost of New Mexico Medicare Supplement plans can vary due to several factors. The monthly premium could be anywhere from $70 to $175.

Lowest premium per Medigap letter plan in New Mexico

New Mexico’s lowest premium available is Medigap Plan K, at just $38, while the highest price you could pay is for Medigap Plan B, at $118. The following low-cost premium quotes represent how much a woman who’s 65 and living in New Mexico could spend on monthly Medigap.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $78 | $118 | $112 | $98 | $117 | $98 | $38 | $61 | $94 | $75 |

Most expensive premium per Medigap letter plan in New Mexico

Some factors significantly increase your Medigap premium, like age and gender. A New Mexico man who’s age 70 pays for a high premium with the following potential quotes.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $416 | $340 | $404 | $236 | $421 | $379 | $134 | $260 | $291 | $371 |

Top Medicare Supplement plan carriers in New Mexico

Top Medicare Supplement and Medigap plans in New Mexico include those from United States Fire, Universal Fidelity, Nassau Life, Lumico, and Manhattan Life. Plan N offers the least expensive pricing for fewer benefits, while Plans F and G cost slightly higher for their added coverage.

The following quotes are for a female from New Mexico that’s 65 years old.

| CARRIERS | PLAN F | G | N |

| United States Fire | $127 | $101 | $81 |

| Universal Fidelity | $121 | $98 | $75 |

| Nassau Life | $126 | $119 | $87 |

| Lumico | $127 | $102 | $81 |

| Manhattan Life | $128 | $100 | $79 |

Cities in New Mexico with estimated Medicare Supplement premiums

Estimated premiums for Medicare Supplement plans for the cities listed below can be accessed with the accompanying charts linked below:

FAQs

What is Medigap in New Mexico?

Medigap is a New Mexico Medicare Supplement where private health insurance carriers cover your coverage gap costs, so you don’t have to.

These plans cover costs like co-pays and deductibles. You won’t receive coverage for dental, hearing, prescriptions, or vision, but you’ll save considerably more on medical expenses than without a plan.

Can Medigap premiums be deducted from Social Security in New Mexico?

Social Security can’t deduct your Medigap premium from your Social Security benefits. Instead, you must pay your private Medigap provider directly. Your Medicare Part B premium still gets deducted from your Social Security benefits.

You’ll also need a standalone prescription coverage plan, as Medigap does not cover these charges.

Do Medigap plans cover drugs in New Mexico?

No, Medigap plans don’t cover drugs in New Mexico. Medigap plans don’t include prescriptions in their benefits anywhere in the country. Medicare Supplement plans are ideal for resolving coverage gaps between Original Medicare and additional expense coverage.

You must enroll during the appropriate window for a prescription drug plan.

When can I apply for Medigap in New Mexico?

You can apply for Medigap in New Mexico during the Open Enrollment Period that starts after you turn 65.

You can get a coverage denial for having a pre-existing condition if you don’t apply during the enrollment window. Depending on your location, you may be able to file an appeal and secure coverage.

Are Medigap premiums based on income in New Mexico?

Private carriers consider many factors when determining your Medigap premium. Income is not one of the factors in determining your premium.

Instead, your carrier examines your age, location, gender, past rate increase history, and other factors to determine how much you’ll pay. Prices vary for everyone as they depend on each individual’s past health insurance history.

How to sign up for Medicare Supplement plan in New Mexico

Signing up for a New Mexico Medicare Supplement or Medigap plan is not difficult. When you need reliable health expense coverage professionals, visit Medigap.com. Our experts have years of experience with Original Medicare, Medicare Advantage, Part D, and Medigap.

Let us know what you need in a plan; we’ll compare the top carriers and help you select. Our agents work with popular insurance providers to ensure you get the best coverage for your needs and our free service.

Call us today or fill out our online request form to receive rates on New Mexico plans in your area.