Michigan Medicare Supplement plans fill in the gaps in their Original Medicare coverage. This means they get help paying for some of the costs not covered by Original Medicare, like copayments, coinsurance, and deductibles.

With various plans available, each with its own benefits, you can choose the plan that best suits your needs. Medicare standardizes Medigap plans. Regardless of the company you choose, the coverage is the same.

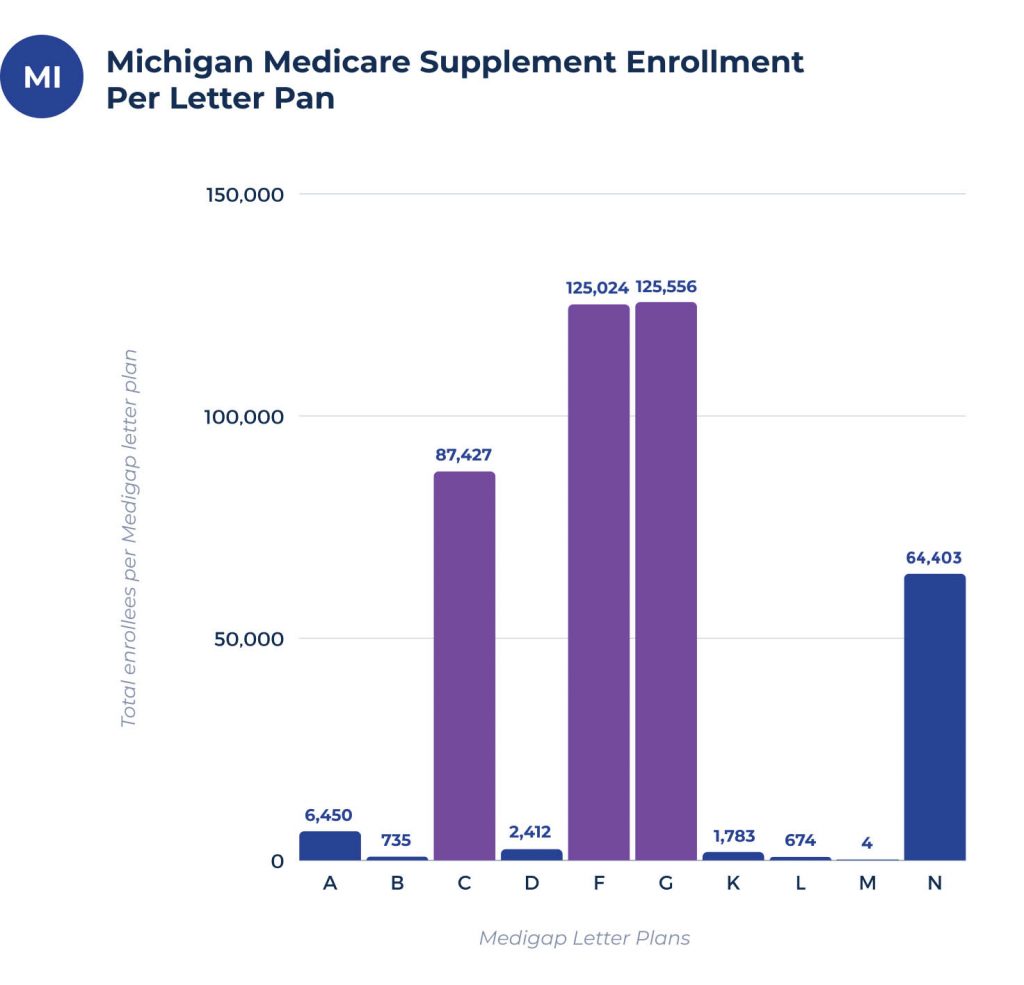

Michigan Medigap enrollment & coverage chart per letter plan

In Michigan, all Medigap plan options are available to Medicare beneficiaries. Currently, there are 429,663 Medicare members enrolled in Medigap plans. Accounting for 32.7% of all Michiganders enrolled in the Medicare system.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 8,005 | 950 | 111,012 | 997 | 139,085 | 85,583 | 1,994 | 803 | 5 | 68,591 |

What are the top Medigap plans in Michigan?

Among the top plans in Michigan are Plan F, Plan C, Plan G, and Plan N. Plan C and F were discontinued for new Medicare members. Plans N and G will be the most popular plans for new beneficiaries.

Medigap Plan coverage chart for Michigan

As seen in the chart below, your coverage can vary depending on the plan Letter you enroll in. The most popular plans available have low out-of-pocket costs when you use the plan.

Since the plans are standardized by the Centers for Medicare and Medicaid Services, coverage will be the same no matter where you live or which Insurance company you choose.

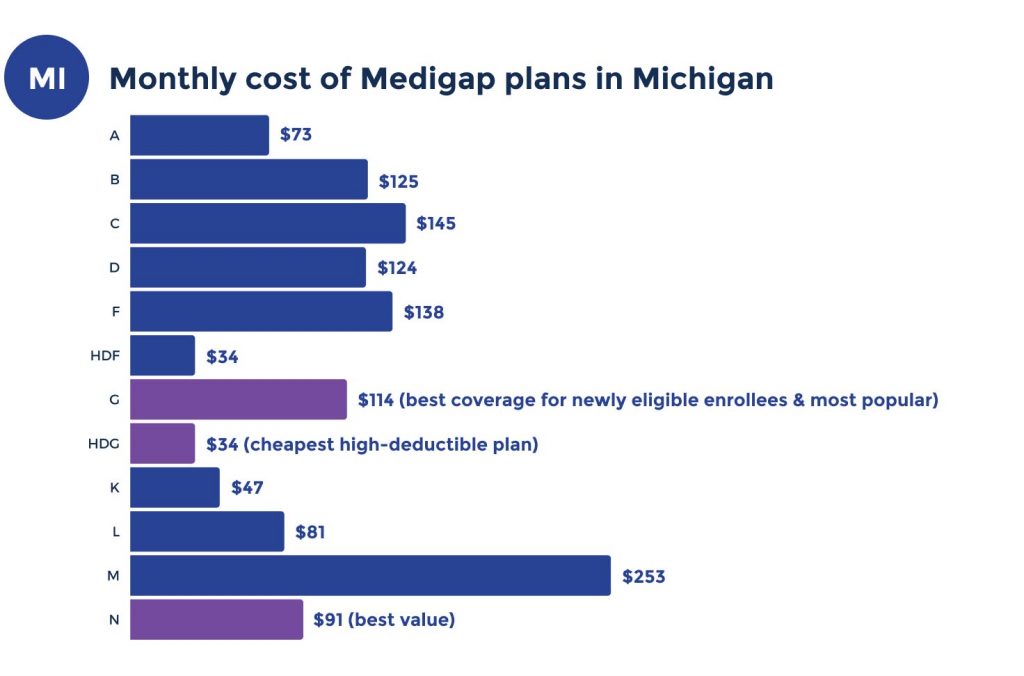

Medicare Supplement plans costs in Michigan

Even though coverage is identical, factors affect your monthly premium no matter where you live or your chosen company.

How old you’re will affect the premium in the state of Michigan. Rates will also differ based on other factors, such as smoking and the area you reside in.

How much does Medigap cost in Michigan?

In Michigan, Medicare Supplement plans typically cost between $90 and $180 monthly. Premiums may differ based on the insurer and the method of premium rating. In addition, several other factors affect the pricing of Medigap plans in Michigan.

Lowest expensive premium per Medigap letter plan in Michigan

Below is an estimate of the most inexpensive premium for a 65-year-old woman in Detroit, Michigan’s Wayne County.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $69 | $119 | $142 | $116 | $142 | $114 | $45 | $85 | $142 | $95 |

Most expensive premium per Medigap letter plan in Michigan

The chart below shows the highest-costing Medicare Supplement premiums in Michigan. The prices listed below are based on a 70-year-old man in Detriot, Michigan’s Wayne County.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $399 | $332 | $387 | $368 | $359 | $285 | $161 | $227 | $348 | $267 |

Top Medigap carriers in Michigan

Next, we’ll provide pricing from some of Michigan’s highest-rated Medicare Supplement providers. The prices are based on a 65-year-old female residing in Wayne County, Michigan.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| Slbi | $136 | $125 | $92 |

| $142 | $114 | $95 | |

| Cigna | $151 | $125 | $96 |

| Allstate | $155 | $144 | $91 |

| BCBS of MI | $186 | $131 | $131 |

Michigan cities with estimated premiums for Medicare Supplement coverage

There are charts with estimated premiums for Medicare Supplement coverage for the below cities:

FAQs

How much does medigap cost in Michigan?

In Michigan, Medicare Supplement plans typically cost between $90 and $180 monthly. Premiums may differ based on the insurer and the method of premium rating. In addition, several other factors affect the pricing of Medigap plans in Michigan.

What’s the most popular Medigap plan in Michigan?

Plan F is the most popular Medicare Supplement plan in Michigan. However, this specific letter plan is not available for Medicare beneficiaries new to Medicare as of January 1, 2020. Plan G is the most popular plan for new Medicare members.

What’s the average cost of a Medigap plan in Michigan?

The plan costs vary depending on the plan you enroll in. The average price of Plan G in Detroit, Michigan, is $128 for a 65-year-old female.

Do Medigap plans in Michigan have subsidies?

Medigap plans don’t have a subsidy to pay the monthly premiums. Income-based subsidies are available for other Medicare costs and Medicare plan options. Some examples of types of plans a subsidy may help with are Medicare Advantage, Medicare Part D plans, and your Medicare Part B premiums.

Which Medicare Supplement plans are available in Michigan?

All available Medigap plan letters are available in Michigan. The most popular are Plans F, C, N, and G. With Plans C and F no longer offered to new beneficiaries, it’s expected that Plan N and Plan G enrollments will skyrocket over the next few years.

How much will my Michigan Medicare Supplement increase next year?

All Medigap plans will increase over time. Age, inflation, and total claims of the plan letter you’re on affect rate increases. Typically Plans N and G have a smaller annual increase than Plans C or F

How to sign up for Medicare Supplement plan in Michigan

Medicare Supplement plans in Michigan are among the most comprehensive Medicare plans you can choose. The road can be confusing, but we’re here to help.

Let our experts guide and educate you on your options. We’ll help you understand your choices and enroll in your chosen plan.

Simply fill out our online request form, or give us a call. Our licensed experts are standing by to help you navigate the roadmap of Medicare.