Original Medicare covers a lot, but it doesn’t cover everything. Medigap supplements help with that, though. And the good thing is they are standardized; if you purchase Plan A in Oklahoma, you’ll get the same benefits as you would purchasing Plan A in Connecticut. The main differences are the monthly premium price and the quality of the carrier selling the policy.

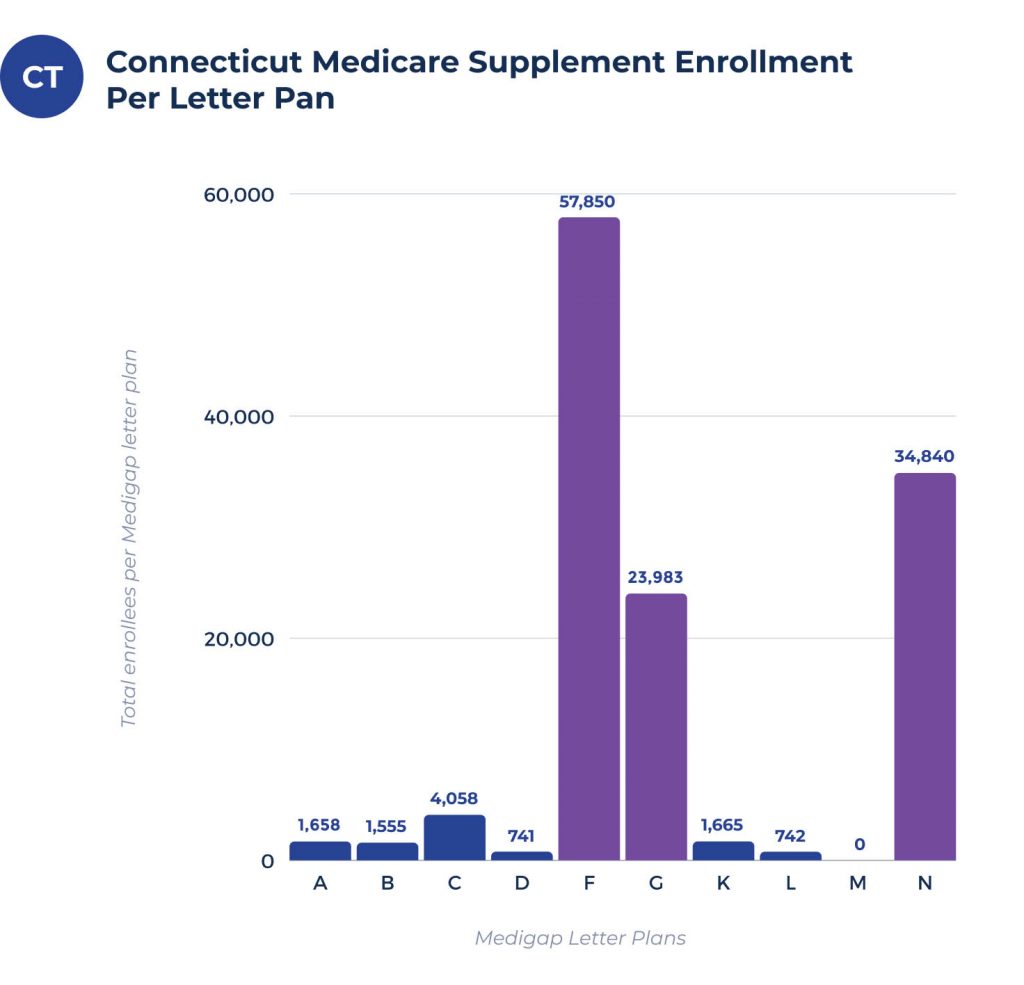

Connecticut Medicare Supplement enrollment per letter plan

Just under 161,000 beneficiaries trust their care to a Medigap supplement. This means that 36.4% of retirees in the state have decided to stay with Original Medicare, which isn’t the most popular option but essential.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 2,053 | 2,338 | 5,880 | 1,084 | 70,804 | 7,793 | 1,859 | 794 | 0 | 33,349 |

What are the most common Medigap plans in Connecticut?

Is it surprising that Plan F, the most comprehensive Medigap plan, is number one in the state of Connecticut? On the one hand, you’d think the most comprehensive plan would be the most popular.

But it usually has the highest monthly premium, so it’s not always the best plan for seniors with tight healthcare budgets.

The next most popular plan isn’t that big of an upset either: Plan N. After all, it covers almost everything that Plan F does, minus Part B excess charges and your annual Part B deductible.

And while it doesn’t pay 100% of your Part B coinsurance, it lets you pay a low copay instead of the total amount. That way, you get to save money on your monthly premiums simultaneously.

Medigap Plan G is a distant third place. But it’s easy to see why. It’s the same price as Plan F in Connecticut but missing the Part B deductible coverage.

You’re not saving all that much money by excluding a minor benefit.

Medigap plan coverage chart for Connecticut

Only Massachusetts, Minnesota, and Wisconsin have unique Medigap plans. But you, as a Connecticut resident, don’t have to worry about that.

Whether you live in Connecticut full-time or are a snowbird who likes to travel south for the winter, your plan will give you the same benefits regardless of your state.

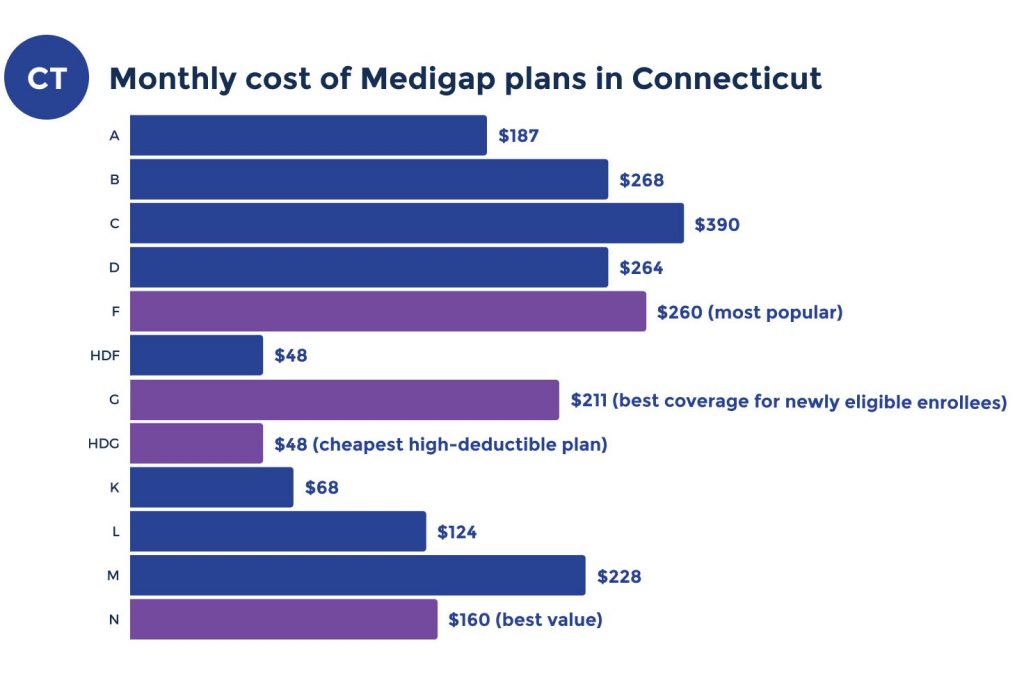

Medicare Supplement plans costs in Connecticut

Finding an affordable monthly premium is the best way to save money on your Medigap insurance. But that can be difficult if the factors aren’t in your favor. For example, being a smoker or enrolling late can increase your monthly premium, among other things.

How much does Medigap cost in Connecticut?

Connecticut Medigap plans are among the highest in the country. This is because of a year-round open enrollment and its community rating. Medigap premiums in Connecticut will average between $180 to $280 per month.

Lowest premium per Medigap letter plan in Connecticut

Overall, some of the most popular plans are relatively affordable in Connecticut. But remember that these estimates are based on a female beneficiary under age 72.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $182 | $267 | $376 | $268 | $260 | $206 | $66 | $123 | $232 | $160 |

Highest premium per Medigap letter plan in Connecticut

If you’re male and over 75, things start getting more expensive. This is especially true if you do something like enroll late or use tobacco.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $1,518 | $1,027 | $436 | $388 | $799 | $628 | $135 | $467 | $608 | $398 |

Top Medicare Supplement plan carriers in Connecticut

Let’s revisit the data for a 72-year-old female beneficiary. Overall, it looks like Connecticare and are offering the best Medigap rates in your area. But you may want to consider other factors like customer service before you purchase a plan based on price alone.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| Connecticare | $260 | $247 | $160 |

| $269 | $206 | $167 | |

| Anthem | $298 | $211 | $169 |

| Globe Life | $326 | $307 | $198 |

| United American | $345 | $362 | $207 |

Cities in Connecticut with estimated premiums for Medicare Supplement coverage

Estimated premiums for Medicare Supplemental coverage for the cities listed below can be accessed via the accompanying charts linked below:

FAQs

How much does Medigap cost in Connecticut?

Connecticut Medigap plans are among the highest in the country. This is because of a year-round open enrollment and its community rating. Medigap premiums in Connecticut will average between $180 to $280 per month.

Does a Medicare Supplement plan include Part D in Connecticut?

The answer is no if you mean the Part D Medicare prescription drug program. But if you purchase a Medicare Supplement, you can also buy a Medicare Part D prescription drug plan. Private insurance companies offer these plans separately to help mitigate healthcare costs.

What is the difference between Medigap Plan D and G in Connecticut?

The difference between these two plans is the Part B excess charges benefit. If you have to get treatment from a medical professional who does not accept Medicare, they can charge you up to 15% more for services. However, enrolling in the Connecticut QMB Program can help protect you from these excess charges and save you money.

Is Medicare Plan G going away in Connecticut?

The short answer is No. Some plans have been removed, but those are Plan F and Plan C. Furthermore, they are only for newer retirees. If you were eligible to enroll in Original Medicare before the year 2020, you’re still eligible for all of these plans.

How to sign up for Medicare Supplement plan in Connecticut

Stop worrying about whether or not you’re getting the best price for your health care. Just complete our rate inquiry form today and start comparing shopping with us!

You will get accurate and free rate quotes within a day or two at the latest. We work with all available carriers so that you know you’re getting the best possible deal.