Medicare Supplement plans, or Medigap plans, are private insurance policies providing additional medical coverage to qualified beneficiaries. Medigap plan coverage doesn’t change among states, private insurance providers, or zip codes, ensuring you receive the same benefits nationwide.

We’ll analyze multiple Alaska Medicare Supplement plans so you can find the perfect policy for you.

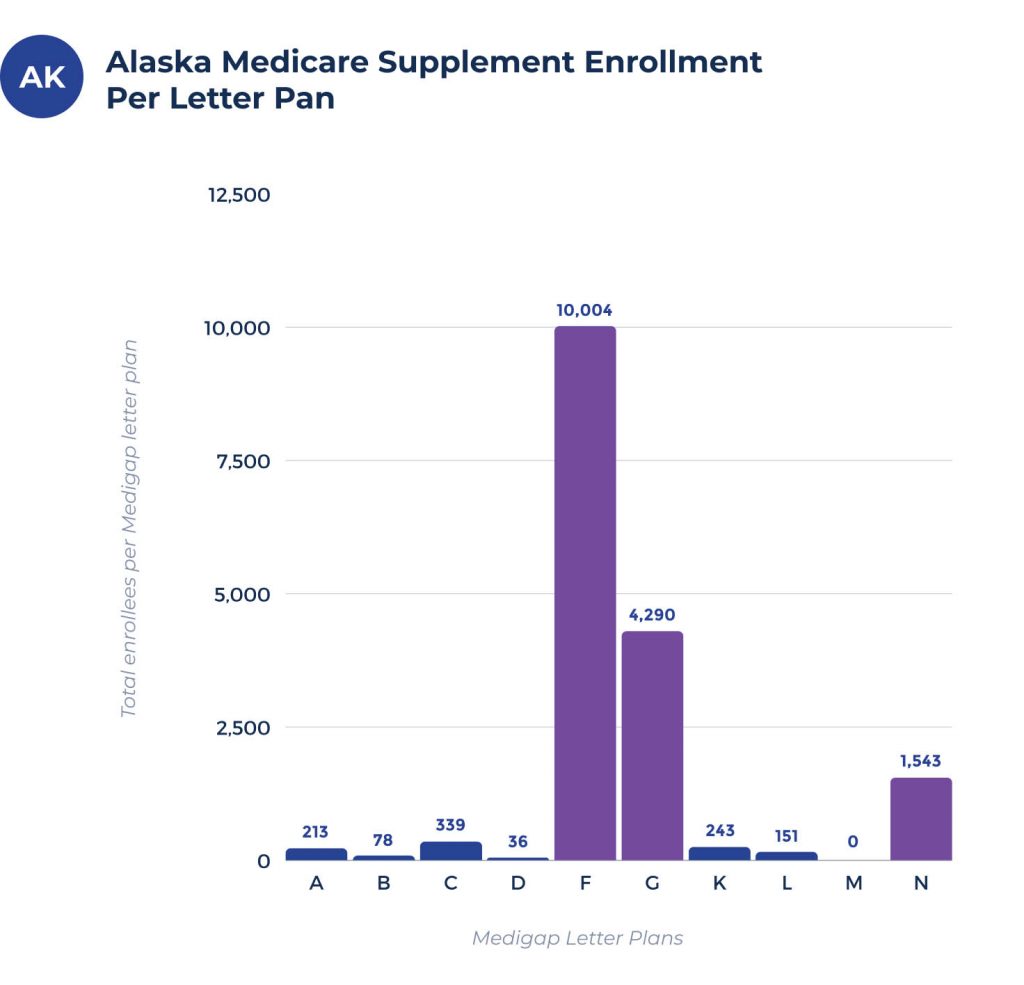

Alaska Medicare Supplement enrollment chart per letter plan

Currently, there are 16,158 Alaska residents enrolled in a Medigap plan. These plans provide several benefits and can make specific healthcare services more economical. The chart below shows a few Alaska Medigap plans and how many beneficiaries fall into each policy.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 266 | 97 | 410 | 57 | 10,735 | 1,713 | 216 | 145 | 0 | 1,242 |

What are the best Medigap plans in Alaska?

Medigap Plan F is the most prevalent plan among Alaska residents. It’s the most comprehensive plan available, giving enrollees extensive medical coverage. Currently, 10,735 Alaska residents have Medigap Plan F coverage.

Medigap Plan G is another prevalent Alaska Medicare Supplement policy. Although it provides slightly less coverage than Medigap Plan F, it’s still one of the most comprehensive policies available in Alaska. Around 1,713 Alaska beneficiaries have Medigap Plan G.

Medigap Plan N is the third most popular Medicare Supplement plan in Alaska. It provides extensive medical coverage and carries a lower monthly premium than other Medigap policies. Medigap Plan N currently covers 1,242 Alaska beneficiaries.

Medigap plan coverage chart for alaska

Again, Medigap plan coverage doesn’t change among states, insurance providers, or zip codes. However, the premiums often fluctuate from state to state, insurance provider to insurance provider, and region to region.

Medicare Supplement plan costs in Alaska

Several factors affect your Alaska Medicare Supplement plan premiums, including but not limited to:

- Age

- Gender

- Location (state and zip code)

- Medical history

- Household discounts

- Payment method

- Price increase history

- Enrollment period

- Price locks

It’s crucial to research each plan and talk to your local private insurance provider to find a quality policy that correlates with your financial means.

How much does Medigap cost in Alaska?

The premium for Medigap plans in Alaska will vary depending on the desired coverage level and the policyholder’s age. Generally, individuals in Alaska can anticipate a monthly fee between $110 and $175.

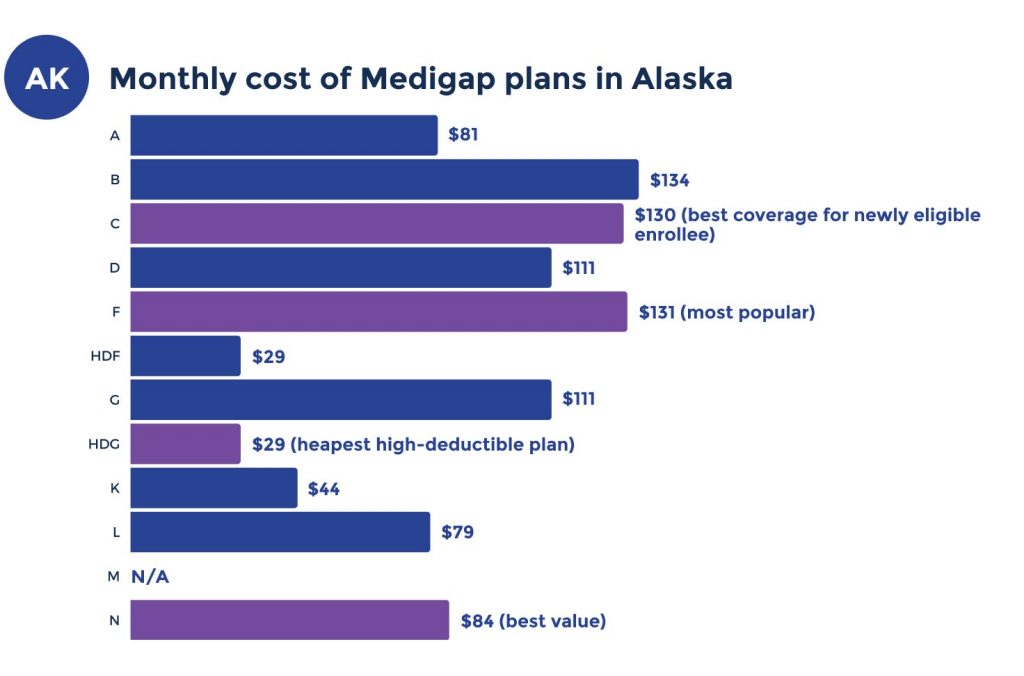

Lowest premium per Medigap letter plan in Alaska

Numerous Medigap policies are more affordable than you might think. We based the following Medigap price chart on 65-year-old female beneficiaries.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $80 | $126 | $129 | $110 | $130 | $110 | $43 | $78 | N/A | $83 |

Most expensive premium per Medigap letter plan in Alaska

It’s important to remember that gender often affects Medigap premium prices. The following chart contains the most expensive Medigap premiums based on 70-year-old male enrollees.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $264 | $368 | $416 | $283 | $417 | $387 | $132 | $209 | N/A | $375 |

Top Medicare Supplement carriers in Alaska

Several high-quality Alaska Medicare Supplement plan carriers provide policies to qualified residents. We’ll focus on 65-year-old female beneficiaries with Medigap Plan F, Plan G, or Plan N.

State Farm Medigap Plan F policies carry $130 premiums, while its Medigap Plan G has $110 premiums. Its Medigap Plan N premiums are the least expensive at $83.

USAA Medigap Plan F beneficiaries pay $140 monthly premiums. Medigap Plan G premiums cost $110 while Plan N sports $107 premiums.

Medigap Plan F premiums are a bit more expensive at $156. Its Plan G premiums are $121, while Plan N premiums cost $103.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| State Farm | $130 | $110 | $83 |

| USAA | $140 | $121 | $107 |

| $156 | $119 | $103 | |

| Humana | $158 | $143 | N/A |

| Globe Life | $172 | $151 | $116 |

When shopping for a Medigap policy, it’s best to research each carrier and its policy premiums until you find the best plan for your healthcare needs without surpassing your financial means.

Alaska cities with estimated premiums for Medicare Supplement coverage

There are charts with estimated premiums for Medicare Supplement coverage for the below cities:

FAQs

How much does Medigap cost in Alaska?

The premium for Medigap plans in Alaska will vary depending on the desired coverage level and the policyholder’s age. Generally, individuals in Alaska can anticipate a monthly fee between $110 and $175.

What are Medigap premiums based on in Alaska?

Numerous factors affect Medigap premiums in Alaska. However, most private insurance providers price their Medigap plans using one of the following rating methods.

- Community-rated

- Issue-age-rated

- Attained-age-rated

The Community-rated method charges every enrollee the same rate regardless of their age. Premiums won’t increase as you age, but they may rise due to inflation and economic factors.

The Issue-age-rated method bases the premiums on the enrollee’s age when they purchase the policy. The monthly premiums won’t change as the beneficiary ages, but younger enrollees typically have lower monthly premiums.

The Attain-age-rated method also bases premiums on the beneficiary’s age, but the premiums increase as they age. Monthly premiums can also rise due to inflation and other contributing factors.

What is not covered by Medigap in Alaska?

Alaska Medigap plans cover various medical services not included in Original Medicare. However, there are a few services Medigap doesn’t pay for, including:

- Long-term care

- Dental

- Vision

- Hearing aids

- Eyeglasses

- Private-duty nursing

Can Medigap insurance be denied in Alaska?

Unfortunately, private carriers can deny Alaskan citizens Medigap insurance due to previous medical conditions.

Providers may deny seniors with specific medical issues like diabetes and heart disease Medigap insurance unless they qualify under certain circumstances. Always talk to a private insurance provider to learn their qualifications.

Can you switch from Medicare Advantage to Medigap in Alaska?

Yes. Alaska Medicare Advantage beneficiaries can switch to a Medigap plan if they meet specific requirements. To do this, beneficiaries must drop their Medicare Advantage plan and reenroll in Original Medicare Part A and Part B during:

- The Medicare Advantage Open Enrollment Period (January 1 through March 31).

- The Annual Election Period (October 15 through December 7). This enrollment period is also known as the Open Enrollment Period for Medicare Advantage and Medicare Prescription drug coverage.

However, Alaska residents can switch from a Medicare Advantage policy to a Medigap plan outside these enrollment periods if they meet specific regulations like moving outside their policy’s service area.

How Many Medigap Policies Can You Have in Alaska?

Alaska residents can’t have more than one Medigap plan at a time. Private insurance providers must limit their policies to one per enrollee.

How to sign up for Medicare Supplement/Medigap plans in Alaska

Medigap.com makes enrolling in an Alaska Medicare Supplement/Medigap plan simple and stress-free. Our team works with Alaska’s top private insurance providers, allowing you to find the perfect Medicare Supplement plan without jumping through hoops.

We have vast industry experience and can help you find a fantastic Medigap policy. Whether you need to find an affordable Alaska Medicare Supplement plan or want to learn more about Medigap policies, Medigap.com is always here for you.

Give us a call or complete our online rate form to get the best Alaska Medicare Supplement plan rates today!