South Carolina Medicare Supplement plans, or Medigap plans, work simultaneously with Original Medicare to pay for costs that Part A and Part B don’t typically cover. These plans feature the same benefits among states as the government standardizes them across carriers. Below, we detail plan costs for Medigap plans in South Carolina.

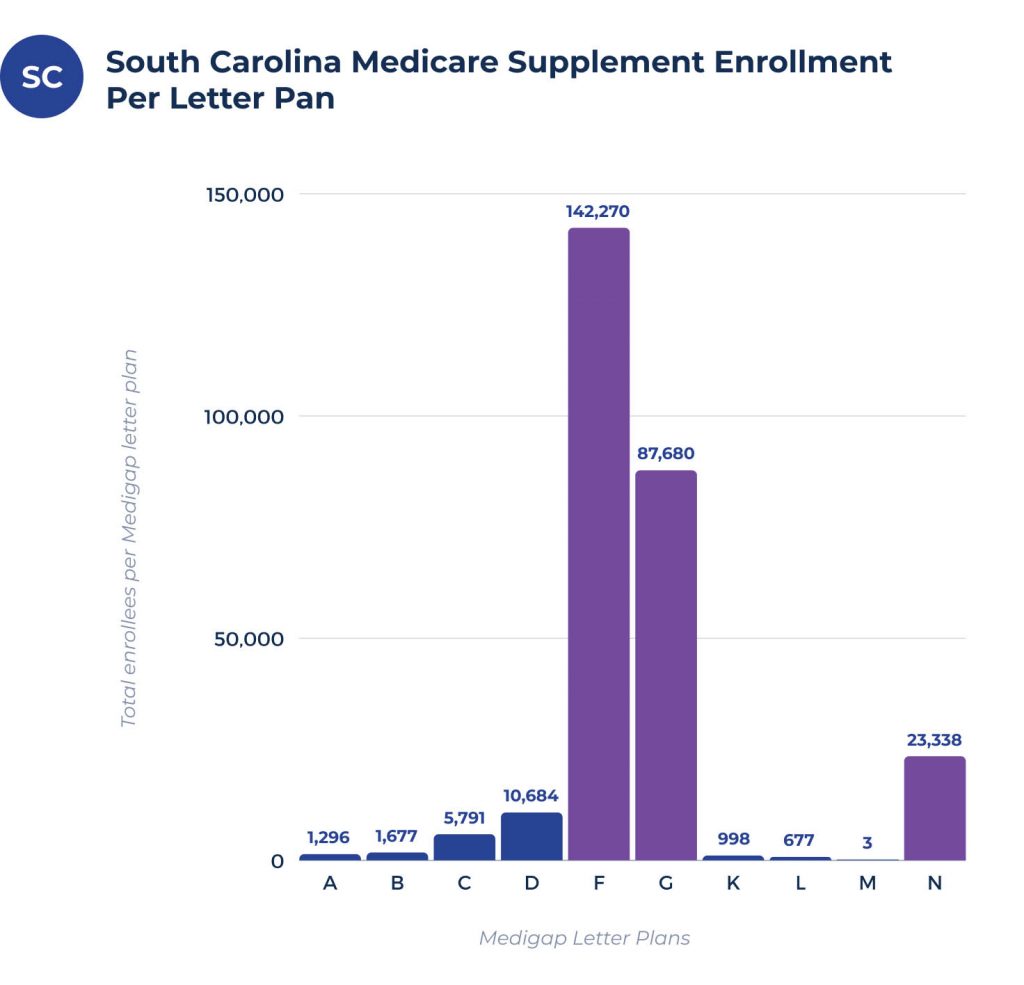

South Carolina Medicare Supplement enrollment per letter plan

As of 2018, there were 276,067 total Medigap enrollees in South Carolina. Of this number, 34.2% of beneficiaries also have Original Medicare’s Fee-for-Service benefits.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 1,577 | 2,244 | 6,420 | 12,898 | 156,466 | 62,199 | 1,192 | 854 | 4 | 24,307 |

What are the popular Medigap plans in South Carolina?

The most popular Medigap plans in South Carolina are Medigap Plan F, Medigap Plan G, and Medigap Plan N.

Medigap Plan F is the most popular option for its full coverage for all Part A and Part B coinsurance, deductibles, and extra expenses. There are 396,195 residents enrolled in the plan, indicating its excellent performance.

Medicare Plan G offers the next best coverage as beneficiaries must only pay the Part B deductible. Around 42,270 patients are enrolled in this plan.

Medigap Plan N is suitable for patients as they must only cover the Part B deductible, excess charges, and copays. Its 65,187 beneficiaries benefit from included copayment coverage.

Medigap Plan coverage

Because South Carolina Medicare Supplement plans are identical across the United States, patients receive the same benefits in South Carolina as they would in another state. How much you pay for these benefits varies.

Medicare Supplement plans costs

Several factors determine your Medigap premium. These include:

- Your location

- Your age

- Your gender

- Payment methods

- Enrollment date

- Tobacco use

- Past rate history

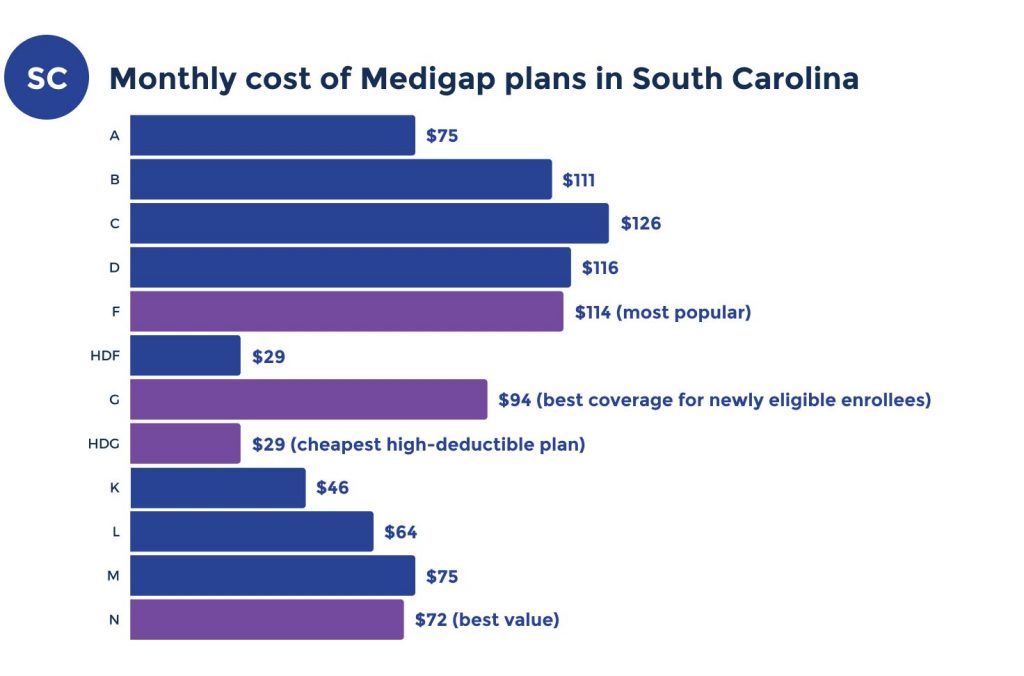

What’s the average cost for a Medicare Supplement plan in South Carolina?

South Carolina Medicare Supplement premiums vary based on a few factors. These monthly premiums range from $75 to $155.

Cheapest premium per Medigap letter plan in South Carolina

South Carolina Medicare Supplement plans vary in price, but many are affordable. These quotes are for a 65-year-old female living in South Carolina.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $77 | $103 | $115 | $106 | $114 | $100 | $47 | $63 | $74 | $74 |

Most expensive premium per Medigap letter plan in South Carolina

The following quotes apply to a male who’s 70 years old and living in the state.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $455 | $339 | $404 | $258 | $434 | $407 | $137 | $268 | $300 | $384 |

Top Medicare Supplement carriers in South Carolina

There are several leading Medigap plan carriers in the state. The following quotes are for a South Carolina female aged 65.

ACE Property and Casualty is the most affordable Medigap plan carrier in South Carolina. At the same time, Royal Arcanum offers the highest prices for Plan F, Plan G, and Plan N. Medico offers a plan similarly priced to SBLI USA’s offerings, with just $77 for Plan N.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| SBLI USA | $116 | $108 | $77 |

| ACE Property and Casualty | $116 | $100 | $78 |

| American Home Life | $123 | $103 | $75 |

| Manhattan Life | $146 | $116 | $88 |

| US Fire Insurance Company | $127 | $103 | $77 |

Cities in South Carolina with estimated premiums for Medigap coverage

The following cities have helpful charts for Medigap coverage’s estimated premiums in South Carolina:

FAQs

How much does Medigap cost in South Carolina?

South Carolina Medicare Supplement plans are expensive for enrollees younger than 65. The average premium costs around $135, but prices are often higher depending on age, location, gender, tobacco use, and many other factors.

Medigap Plan C could cost nearly $1,200 monthly for those in the high-risk pool. In South Carolina, you may be eligible for financial assistance to cover high Medigap expenses.

What is the most comprehensive Medicare Supplement plan in South Carolina?

The most comprehensive Medicare Supplement plan in South Carolina is Medigap Plan F.

Do Medigap premiums increase with age in South Carolina?

Depending on their chosen plan, Medigap premiums may increase with age for South Carolina beneficiaries. Attained age-rated policies depend on how old you’re and increase as you age, while Medigap bases issue age-rated plans on how old you were when you first applied for the program and won’t increase with age.

Age doesn’t affect South Carolina community-rated plans. However, premium cost increases are still possible for other reasons.

What Medigap plans are no longer available in South Carolina?

Medigap occasionally removes plans to avoid medical overspending, and the following Medicare Supplement plans are no longer available in South Carolina include:

- Plan E

- Plan H

- Plan I

- Plan J

The below plans are only available to Medicare beneficiaries that were eligible before January 2020

- Plan C

- Plan F

- High Deductible Plan F

Medigap has discontinued Plan F and High Deductible Plan F, but beneficiaries who applied before 2020 can still receive these plans’ offerings. South Carolinians can still get excellent coverage benefits by applying for Medigap Plan G, Medigap Plan N, or another alternative.

Can you change your Medicare Supplement plan at any time in South Carolina?

Changing your Medicare Supplement plan in South Carolina whenever you want is possible, but your chances of acceptance increase significantly if you wait for a designated enrollment period. The Medigap Open Enrollment Period that begins one month after you turn 65 is the best time to sign up as it guarantees acceptance.

How to sign up for Medicare Supplement plan in South Carolina

Whether you need full coverage for deductibles and copays or find that a different Medigap plan would meet your healthcare coverage requirements, our team can help you find a suitable carrier and plan.

We compare all South Carolina Medicare Supplement plans for your area. Call our experts to get rates today, or fill out our online rate form.