Medicare Supplement plans are health insurance plans that help fill the gap in your coverage. While Original Medicare covers many of your medical expenses, it does not pay for all of them.

Some Medicare Supplement plans help cover Part A and Part B deductibles. Investing in Pennsylvania Medicare Supplement plans can ensure that your insurance policy covers all necessary expenses.

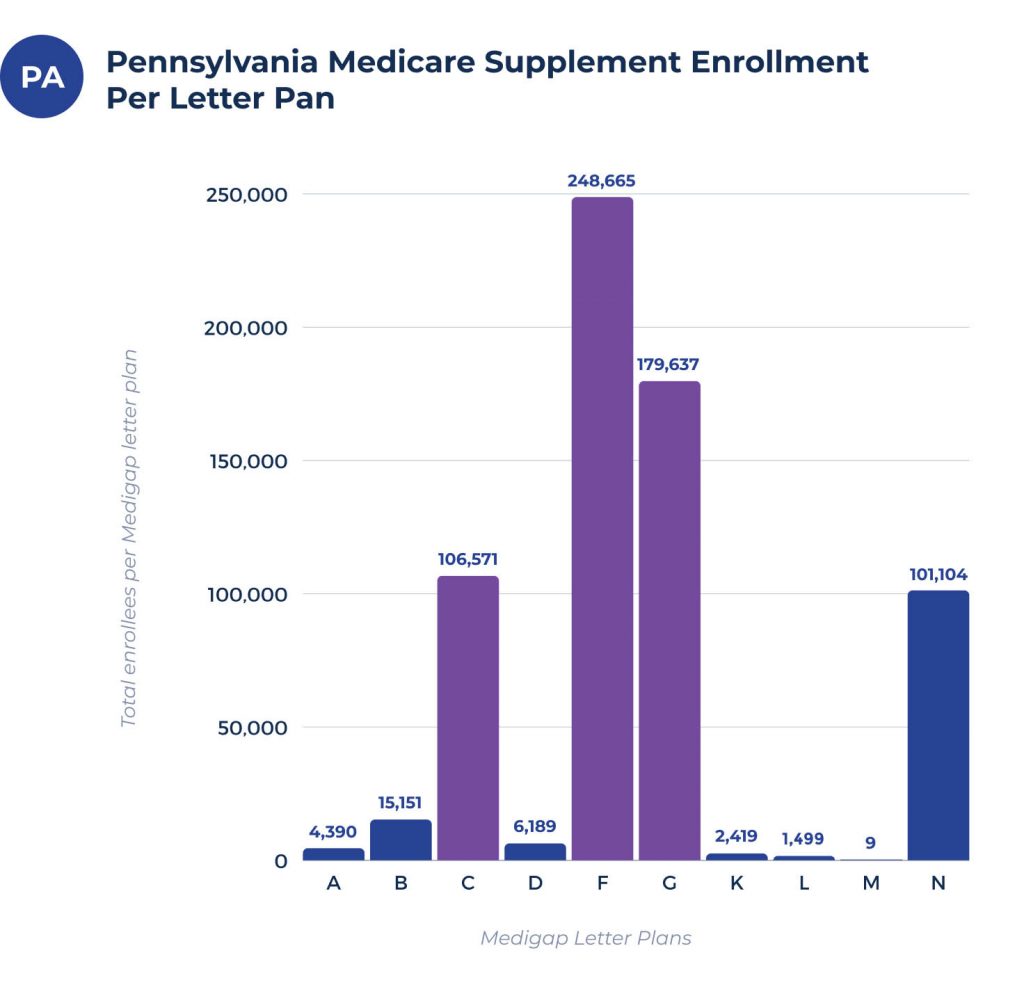

Pennsylvania Medigap enrollment & coverage chart per letter plan

Over 700,00 Pennsylvania residents enroll in Medigap coverage. It allows them to cover medical and emergency expenses that their Original Medicare does not. Approximately 41% of FFS enrollees are part of a Medicare Supplement program.

Below are the Pennsylvania residents enrolled in each Medicare Supplement letter plan.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 5,263 | 20,890 | 136,790 | 8,150 | 268,334 | 111,214 | 2,742 | 1,698 | 15 | 98,734 |

What are the top Medigap plans in Pennsylvania?

While we would love to suggest the best Medicare Supplement plan for our readers, it depends on specificities like age, gender, location, and more. Medicare Supplement Plans G, N, and F typically benefit patients the most.

Some benefits of Pennsylvania Plan G coverage include low out-of-pocket costs and premiums. Since new Medicare members don’t qualify for Plan F, Plan G is the best coverage for most people.

Alternatively, Plan N offers perfect coverage, ensuring you’re not paying for services you don’t need.

Plan F is the most comprehensive Medicare coverage available to Pennsylvania residents. Once you qualify for Plan F, there is no reason not to enroll.

Medigap plan coverage chart for Pennsylvania

Below is a chart outlining the details of each Medigap letter plan. Each has unique benefits for policyholders. While many Medicare coverage variables vary by state, the information on this chart applies across the board.

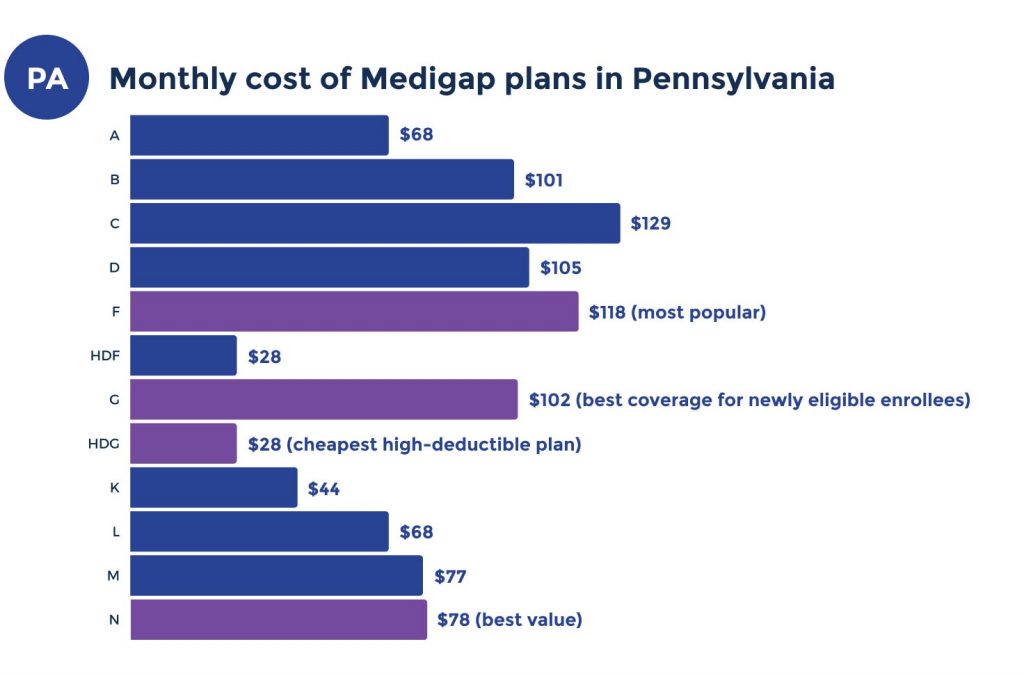

Medicare Supplement plans costs in Pennsylvania

Many factors impact your Pennsylvania Medigap premium. These variables include age, gender, location, and more.

Each state offers different rates for Medicare Supplement plans. While these plans provide the same benefits, they vary in price.

Typically, women are healthier than men. Therefore, they often pay less a premium for their Medicare Supplement plans.

What’s the average cost for a Medicare Supplement plan in Pennsylvania?

Pennsylvania Medigap premiums will vary because of several factors. The monthly premiums range from around $90 to $175.

Lowest premium per Medigap letter plan in Pennsylvania

Below is a chart detailing the premium costs of each Medigap letter plan in Pennsylvania. These figures are representative of a 65-year-old man.

These numbers are estimates based on several factors, including gender, enrollment dates, and overall health.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $68 | $113 | $142 | $120 | $133 | $118 | $48 | $77 | $86 | $90 |

Most expensive premium per Medigap letter plan in Pennsylvania

This list outlines Pennsylvania’s most expensive premium per Medigap letter plan. These numbers are indicative of a 70-year-old male.

Remember that the older you’re, the more likely you will be on prescription drugs. If you’re healthy, you may pay less than the below premiums.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $369 | $393 | $528 | $277 | $530 | $509 | $162 | $304 | $345 | $435 |

Top Medicare Supplement plan carriers in Pennsylvania

Lastly, here are the leading Medicare Supplement carriers in Pennsylvania. These quotes apply to men and women aged 65-70.

As the chart displays, Plan N is the most affordable option for people between 65 and 70. Many of these Pennsylvania coverage carrier options are comparable.

The only difference between Medigap insurance providers is the amount you pay for them. They all provide the same benefits.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| SBLI | $144 | $131 | $98 |

| Medico | $150 | $124 | $96 |

| Physicians Life | $152 | $133 | N/A |

| Aetna | $182 | $142 | $98 |

| Cigna | $187 | $150 | $103 |

Cities in Pennsylvania with estimated premiums for Medicare Supplement coverage

There are charts with estimated premiums for Medicare Supplement coverage for the below cities:

FAQs

What is the best Medicare Supplement plan in Pennsylvania?

The best Pennsylvania Medicare Supplement plan is different for each person. It depends on factors such as age, prescribed medications, and health conditions. Many online resources can help you determine which Medigap plan is best for you.

Typically, Plans F and G are the best options available. Plan F is the standard-bearer for Medicare Supplement insurance. However, new Pennsylvania Medicare members are ineligible for Plan F. Therefore, Pennsylvania Plan G is now the best health insurance plan for Medicare patients.

How much is a Medicare Supplement per month in Pennsylvania?

Each insurance provider has a different premium price. You can usually expect to pay between $145 and $220 for monthly Pennsylvania Medicare Supplement premiums.

However, these prices vary depending on your health condition, age, and location. Therefore, you must research before signing up for a Medigap plan.

What is the difference between a Medicare Advantage plan and a Medicare Supplement plan in Pennsylvania?

The principal difference between Pennsylvania Medicare Supplement plans and Medicare Advantage plans is that an MA plan aims to provide you with Medicare benefits. Alternatively, a Medigap plan helps you afford these benefits.

However, a Medigap plan does not provide these benefits directly. Although, Medicare Supplement plans will help you pay some Part A and Part B deductibles.

How many Medicare Supplement plans can you have in Pennsylvania?

Medicare qualifiers in Pennsylvania can have up to 10 Medicare Supplement plans. These plans have different letters attached to them and offer unique benefits to policyholders.

Each insurance policy provides the same benefits for their lettered coverage plans.

Are you automatically disenrolled from Medicare Advantage to Medigap in Pennsylvania?

Your Medicare Advantage plan will end automatically when you enroll in a Pennsylvania Medigap plan. You can’t have both of these plans simultaneously.

How to sign up for Pennsylvania Medicare Supplement plans

We help thousands of Pennsylvania residents annually sign up for Medicare and Medigap plans. Working with the best Medicare Advantage providers in Pennsylvania, we will help you get the rates you deserve. You can get quotes from these healthcare insurance providers by filling out our online rate form.

For more information about Pennsylvania Medicare Supplement coverage plans, give us a call or complete our online rate form here.