Maine Medicare Supplement or Medigap plans work with Medicare to cover all or most costs of beneficiaries’ medical expenses.

The government standardizes these plans, making their benefits the same across all carriers and locations. How much you pay varies depending on various factors.

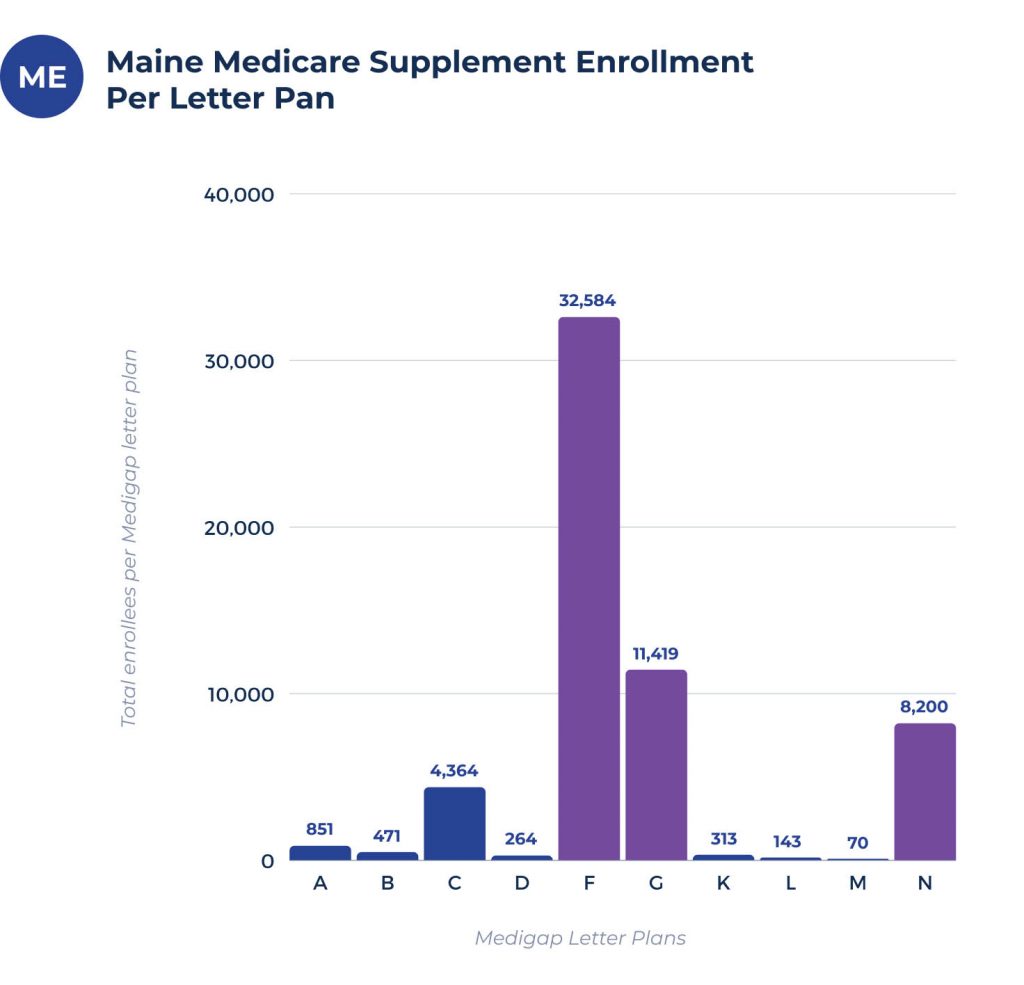

Maine Medicare Supplement enrollment per letter plan

Maine has 69,198 Medigap enrollees currently. Of all beneficiaries with Fee-for-Service Medicare, 28.6% also have a Medigap plan. Maine is one of only ten states with similar enrollment numbers. Below are the number of enrollees for each Medigap letter plan in Maine.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 1,102 | 624 | 6,348 | 348 | 42,879 | 4,063 | 368 | 188 | 96 | 8,351 |

What Are the top Medigap plans in Maine?

Regarding the top Medigap plans in Maine, Medigap Plan F is significantly more popular than any other plan. Its 42,879 enrolled beneficiaries are proof of this.

Plan N is the next most popular option, with 8,351 enrollees. Medigap Plan C is the third most popular plan, with 6,348 enrollees, while Plan G has only 4,063.

Medigap Plan coverage chart for Maine

Medicare Supplement plan benefits such as those in the following chart don’t change across states. Patients in Maine get the same benefits as patients in Missouri and every other state.

Medicare Supplement plans costs in Maine

Although benefits stay the same in every state, premiums in Maine vary depending on factors including your:

- Location

- Age

- Gender

- Tobacco use

- Date of Enrollment

- Previous rate increases

Your costs could be well over $350 depending on the plan and the factors that increase them.

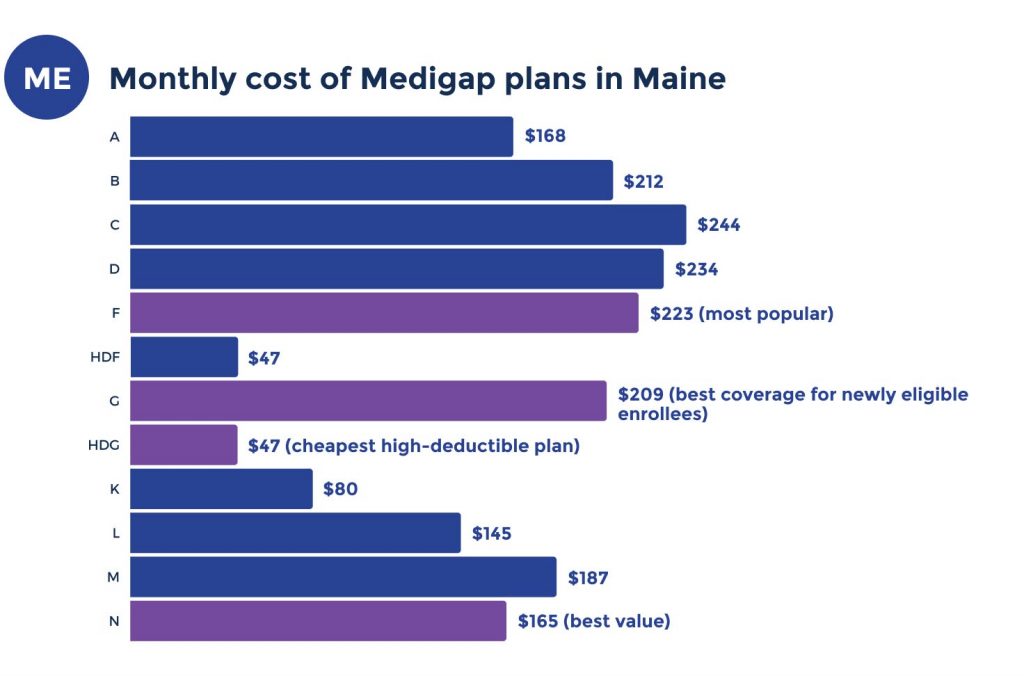

How much does Medigap cost in Maine?

In Maine, Medicare Supplement plans will vary in premium. You can expect Maine Medigap monthly premiums to range between $160 to $240.

Inexpensive premium per Medigap letter plan in Maine

There are many affordable Medigap plans. The following Maine Medicare Supplement quotes represent potential premium costs for a 65-year-old woman living in Maine.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $162 | $213 | $244 | $214 | $222 | $209 | $79 | $143 | $185 | $164 |

Highest premium per Medigap letter plan in Maine

Your premiums may increase with certain factors, such as gender. The following Medigap plan quotes are the highest prices you could potentially pay if you’re a 70-year-old male in Maine.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $307 | $363 | $315 | $260 | $396 | $316 | $151 | $239 | $326 | $235 |

Top Medicare Supplement plan carriers in Maine

The figures in the following chart explain the premium costs for Plan F, Plan G, and Plan N in Maine. We based the following quotes on a 65-year-old female Maine beneficiary.

Top carriers with the most affordable offerings include USAA Life and Anthem. Out of all the top plans in the state, you’ll pay the least for Plan G and the most for Plan F by the same carrier, Colonial Penn.

| CARRIERS | PLAN F | G | N |

| USAA Life | $222 | $208 | $180 |

| Anthem | $237 | $213 | $171 |

| United of Omaha | $240 | $212 | N/A |

| Cigna | $250 | $209 | $164 |

| Colonial Penn | $396 | $85 | $235 |

Estimated premiums for Medicare supplemental plans in cities in Maine

The following graphs present an approximation of the premiums for a range of Medicare Supplement plans for the specified cities:

FAQs

How much does Medigap cost in Maine?

In Maine, Medicare Supplement plans will vary in premium. You can expect Maine Medigap monthly premiums to range between $160 to $240.

How do I choose a Medicare Supplement plan in Maine?

When choosing a Medicare Supplement plan, it’s best to compare the top insurance companies and their offerings. Visit Medigap.com or contact insurance providers directly. Finding a plan that meets your insurance needs and budget is crucial.

Getting information from Medigap.com ensures you have the latest and most accurate information on Maine plans, regardless of age, gender, and other factors.

Why is Plan F being discontinued in Maine?

Plan F will no longer be available to new Maine Medicare Supplement plan enrollees because new legislation states that carriers can’t cover Original Medicare Part B’s deductible in Medicare Supplement plans. Since Plan C covers the Part B deductible, it will no longer be available.

However, Maine Medicare Supplement beneficiaries enrolled before 2020 can still apply for Plan F. If you miss this enrollment window, you’ll no longer have access to Plan F or Plan C.

What Medigap plan is the most popular in Maine?

Medigap Plan F is the most popular in Maine. It currently has over 40,000 beneficiaries.

The plan covers all expenses, from extra charges to temporary nursing home stays. However, Plan N appears to be rising in popularity in the future as many new applicants can no longer apply to Plan F.

What is the difference between a Medicare Advantage plan and a Medicare Supplement in Maine?

A Medicare Advantage plan bundles Medicare Part A, B, and often Part D coverage. Depending on your plan, it may include vision or dental insurance and multiple other benefits.

Maine Medicare Supplement plans, or Medigap plans, cover the expenses that Original Medicare doesn’t cover. You’ll still get some coverage through Original Medicare, but you’ll need to purchase a standalone Part D plan and additional dental, vision, and hearing coverage.

What is the difference between Plan G and Plan N in Maine?

Plan G is considerably less popular in Maine than Plan N. Plan G provides significantly more benefits and coverage than Plan N, such as full Part B coinsurance coverage and excess charges. However, you’ll save more money with Plan N than with Plan G.

Plan N premiums are cheaper than Plan G premiums, but you’ll pay for excess Part B charges and the Part B deductible.

How to sign up for Medicare Supplement plan in Maine

Now that you know how to sign up for a Medicare Supplement plan in Maine, it’s time to start.

Visit Medigap.com today to compare plans and choose the best coverage for your needs. Our website is constantly updated with the latest information on carriers and their Medigap plans, so you can be sure you’re making an informed decision.

Let our licensed insurance agents help you find the right plan for your medical and financial needs. Call us today, or complete our online rate form for the best price quotes in your area.