North Dakota Medicare Supplement plans, or Medigap, provide additional health coverage to supplement Original Medicare. These plans can help pay for deductibles, copayments, and coinsurance costs to help Medicare beneficiaries lower their healthcare expenses and receive better coverage.

Medicare Supplement plans have federal government standardization, so benefits remain the same across all carriers and states, although premiums will vary.

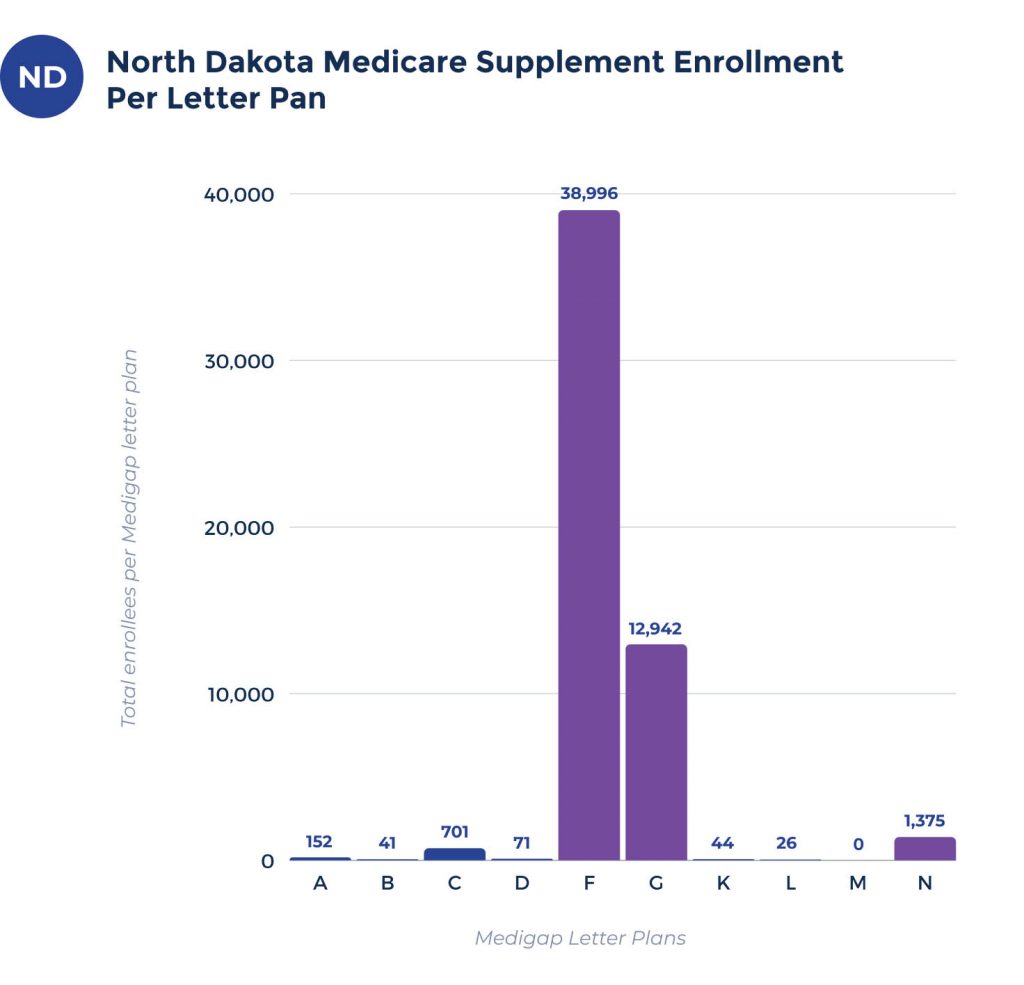

North Dakota Medicare Supplement enrollment chart per letter plan

In North Dakota, about 53,831 people have Medigap policies. Among those enrolled in Fee-for-Service Medicare, 48% have opted for Medigap plans. Medigap policies come standardized with 10 letter plans from A through N.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 173 | 54 | 926 | 98 | 44,183 | 6,416 | 37 | 26 | 0 | 1,085 |

What are the top Medigap plans in North Dakota?

Medigap plans don’t have provider networks. Additionally, states require insurance companies to sell only standardized policies. Plan members can use their insurance at any doctor or hospital that accepts Medicare.

In North Dakota, Medigap Plan F has 44,183 enrollees. Plan F remains popular and offers comprehensive coverage that pays for 100% of Part B excess charges. Unfortunately, only Medicare beneficiaries eligible before January 1, 2020, can enroll in Plan F.

The next most popular plan, Medigap Plan G, has approximately 6,416 enrollees. Plan G provides similar care and benefits to Plan F but has a small annual deductible and full coverage for out-of-pocket expenses.

Medigap Plan N has 1,085 enrollees and provides a wide range of coverage. Plan N pays for 100% of Medicare Part B coinsurance but requires a $20 copayment for doctor visits and $50 for emergency care. Additionally, Plan N has low premiums making it an attractive option.

Lastly, Medigap Plan C has 926 enrollees. Plan C provides 365 additional days of Part A coinsurance after Medicare benefits end. Plan C also pays for 20% of all Medicare Part B expenses, including copayments and outpatient services.

Medigap plan coverage chart for North Dakota

Medigap plans can help pay for Medicare Part A and Part B medical coverage gaps. All insurance companies offer the same basic benefits for Medigap plans. In addition, the coverage and services of your Medigap plan will remain the same across all states.

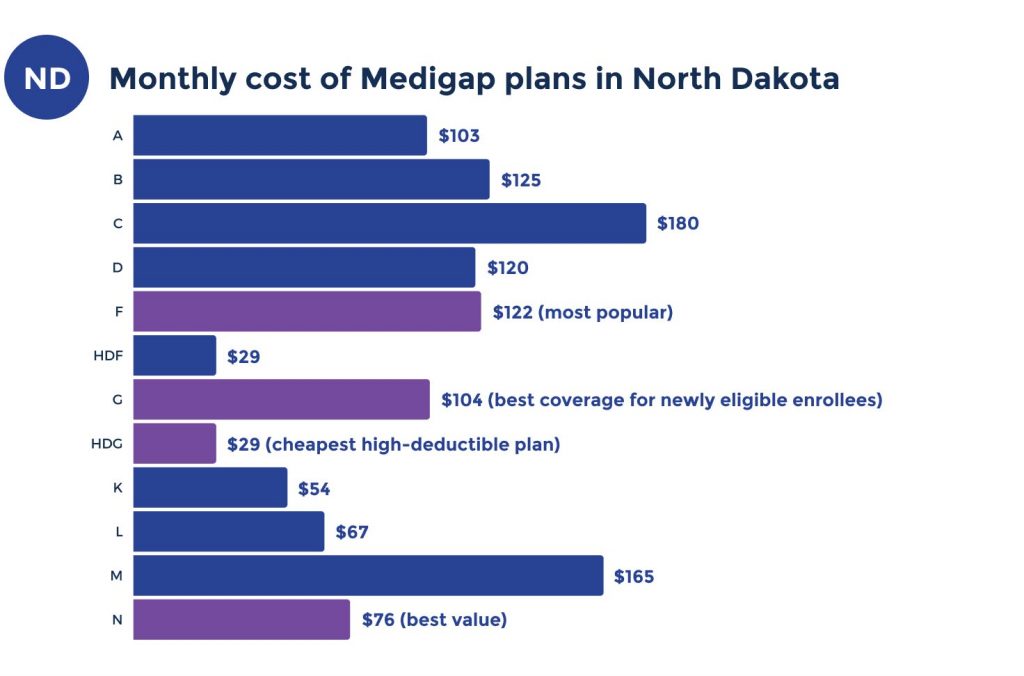

Medicare Supplement plan costs in North Dakota

North Dakota Medicare Supplement plan costs can vary based on your unique health needs. For example, these plans can have different premiums based on where you live.

Medicare Supplement plan rates depend on many factors, including location, gender, age, tobacco use, enrollment date, etc.

What’s the average cost for a Medicare Supplement plan in North Dakota?

The cost of a Medicare Supplement plan in North Dakota can vary because of serveal factors. The monthly premium could range from $75 to $180.

Inexpensive premium per Medigap letter plan in North Dakota

The Medigap letter plan premiums and quotes listed below use data from a 65-year-old female beneficiary living in North Dakota. These numbers show the lowest monthly premiums a beneficiary could expect to pay.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $86 | $124 | $144 | $119 | $124 | $103 | $54 | $66 | $104 | $75 |

Highest premium per Medigap letter plan in North Dakota

The Medigap letter plan premiums and quotes listed below use a 70-year-old male living in North Dakota as their basis. These quotes can give you a better idea of these plans’ most expensive monthly premiums.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $254 | $329 | $363 | $320 | $365 | $309 | $131 | $184 | $227 | $253 |

Top Medicare Supplement/Medigap plan carriers in North Dakota

The chart below shows the top Medicare Supplement plan carriers based on a 65-year-old female residing in North Dakota. These plans are a good place to start if you are exploring Medigap options.

American Home offers Medigap Plan F for $124 monthly, Plan G for $103, and Plan N for $75. American Benefit charges around $125 monthly for Medigap Plan F, $103 for Plan G, and $75 for Plan N.

Lastly, American Financial sells Medigap Plan F for around $126 monthly, Plan G for $107, and Plan N for $82.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| American Home | $124 | $103 | $75 |

| American Benefit | $125 | $103 | $75 |

| American Financial | $126 | $107 | $82 |

| Nassau | $126 | $120 | $87 |

| Cigna | $127 | $122 | $80 |

Estimated premiums for cities in North Dakota with Medicare Supplement coverage

You can find charts with estimated premiums for various types of Medicare Supplement coverage for the below cities:

FAQs

How do I choose a Medicare Supplement plan in North Dakota?

To choose the right North Dakota Medicare Supplement plan, evaluate your health needs and compare them to the benefits the policy offers. Medigap policies should fit your budget and provide coverage for your current and future healthcare needs.

Do Medigap plans have a Maximum Out-of-Pocket in North Dakota?

Most Medigap plans do not have a maximum out-of-pocket (MOOP) limit in North Dakota. Thisis because they pay the majority of the costs related to your Medicare. Plans K and L have a MOOP.

What is not covered by Medigap in North Dakota?

Medigap does not provide coverage for prescription drugs, long-term care, and private nurses. Medigap policies exclude ancillary services such as dental, vision, and hearing.

Do Medigap plans increase with age in North Dakota?

Medigap policies have a three pricing methods:

The Community-rated tier charges participants the same premium rates regardless of age.

The Issue-age-rated policy charges premiums based on your age when you sign up.

Finally, the Attained-age-rated plan offers premiums based on your current age and increases as you age.

Are Medigap premiums based on income in North Dakota?

Medigap premiums do not change based on income, but Medicare uses the modified adjusted gross income (MAGI) method.

For example, Medicare Part B costs more for people who the Social Security Administration considers higher-income beneficiaries.

Based on your tax return filed for the previous year, Social Security will calculate your Medicare costs for 2022.

How to sign up for Medicare Supplement/Medigap plan in North Dakota

Medigap.com offers free services and resources to help you find the best North Dakota Medicare Supplement plan.

Our licensed insurance agents work with all carriers and can answer any Medigap policy questions you may have.

Get in touch by calling us or filling out our online rate form to get connected with the best rates in your area today.