Delaware Medicare Supplement plans work alongside Original Medicare to give beneficiaries more well-rounded coverage. Often called Medigap plans, they cover gaps left by traditional Medicare, leaving enrollees with substantial medical costs.

The federal government standardizes these plans, meaning their benefits don’t change state-to-state or with different carriers. However, monthly premiums vary with different carriers and depend on various other factors.

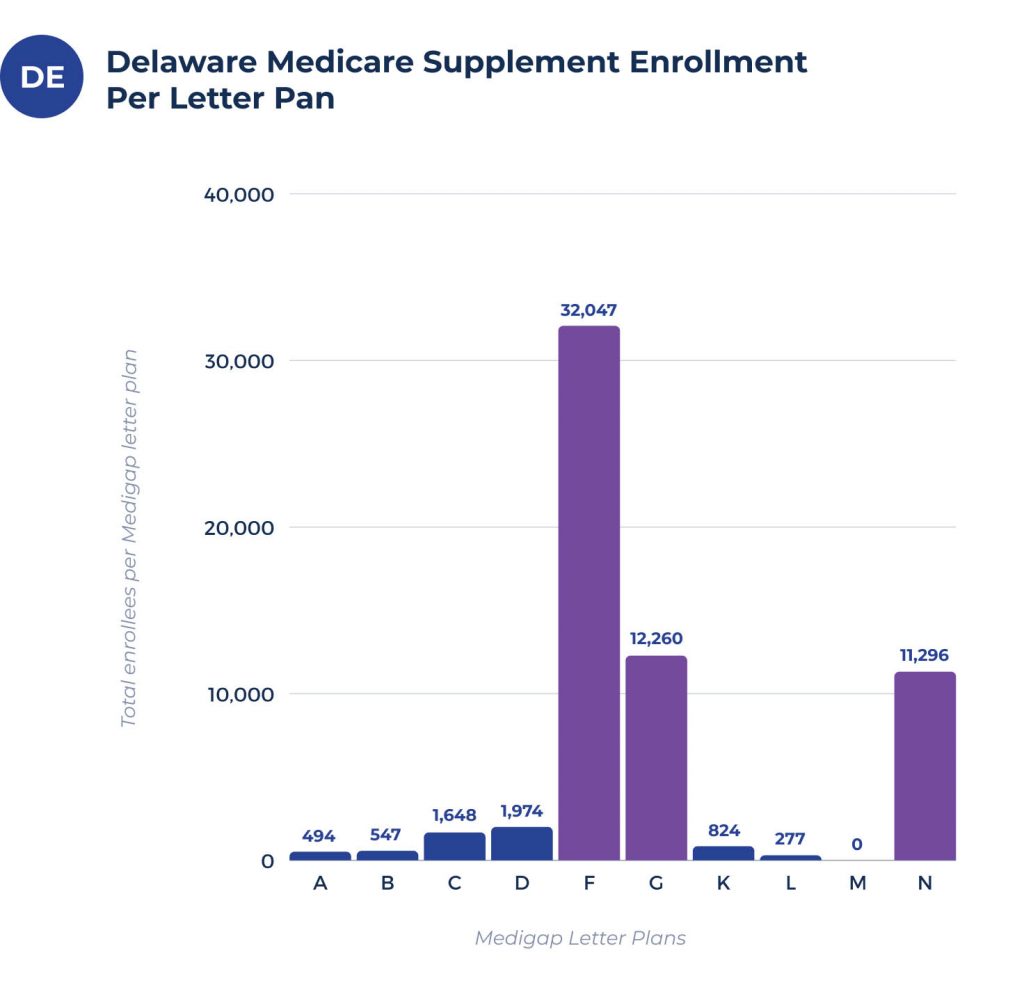

Delaware Medigap enrollment & coverage chart per letter plan

Currently, about 64,170 residents are enrolled in a Delaware Medigap plan. Percentage-wise, this figure accounts for about 35.1%. In the U.S., the total number of residents enrolled in a Medigap plan is around 13,990,820.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 599 | 663 | 1,801 | 2,273 | 34,281 | 6,709 | 910 | 302 | 0 | 11,161 |

What are the most popular Medigap plans in Delaware?

Most Delaware residents are enrolled in Plan F. While this plan typically carries higher monthly premiums than other plans, many prefer it due to its comprehensive coverage.

For example, Plan F covers the Part B deductible and many gaps left by Part A and Part B Original Medicare. While patients pay more when using Plan F, residents with frequent medical needs choose this plan because of its extensive coverage.

The second most popular plan listed is Plan N, which has 11,161 enrolled beneficiaries. This plan is an excellent option if you frequently travel outside the country, as it covers up to a certain amount of emergencies during travel.

The third most popular plan included on this chart is Plan G which has 6,709 enrollees. Like Plan F, Plan G covers excessive Part B charges. Additionally, this plan also covers emergency costs abroad to a certain amount.

Plan D is another popular plan, with 2,273 enrollees. This plan has no out-of-pocket limits and also covers emergency medical care in foreign countries up to a specific limit.

Delaware residents may also choose Plan C, which has 1,801 residents enrolled. Using this plan, there are no out-of-pocket limits.

Medigap plan coverage chart for Delaware

It’s important to note that the benefits listed in the chart below don’t change from state to state. The reason for this is that the government standardizes these benefits. However, premiums and deductibles vary depending on the specific region.

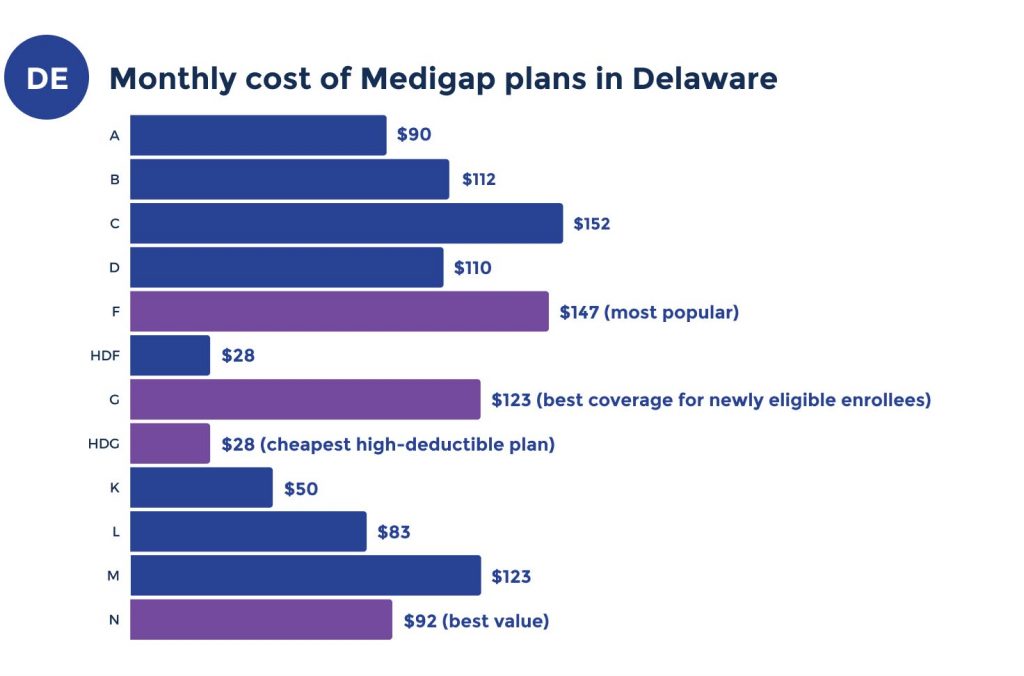

Medicare Supplement plans costs in Delaware

While Medigap benefits don’t change, their premiums do. Many factors influence your premium amounts, such as your location, gender, age, rate locks, the time you enrolled, if you use tobacco, the history of your rate increase, how you pay, and household discounts.

How much does Medigap cost in Delaware?

Delaware Medicare Supplement premiums will vary depending on several factors. The factors most impactful for rates are your age and the Plan letter you choose. Medigap premiums in Delaware range between $120 and $170.

Cheapest premium per Medigap letter plan in Delaware

Each plan carries different premium amounts, as indicated by the table below. The following Delaware Medicare Supplement data revolves around a female that’s 65 years old.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $89 | $111 | $150 | $109 | $147 | $122 | $49 | $82 | $122 | $91 |

Most expensive premium per Medigap letter plan in Delaware

The Delaware Medicare Supplement data gathered below is based on a male that’s 70 years old. As indicated by the higher prices in the chart, gender and age often affect premiums.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $438 | $377 | $423 | $319 | $500 | $410 | $141 | $300 | $333 | $314 |

Top Medicare Supplement/Medigap plan carriers in Delaware

The chart’s data below is based on a typical 65-year-old female beneficiary in Delaware. Plan F has the most expensive premiums regardless of carrier, and Plan N has the least costly premiums regardless of the carrier.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| Manhattan Life | $147 | $129 | $95 |

| American Financial | $148 | $127 | $97 |

| Royal Arcanum | $149 | $126 | $97 |

| Physicians Life | $150 | $131 | $108 |

| $152 | $125 | $103 |

Cities in Delaware with estimated premiums for Medicare Supplement coverage

The below cities have had simple, informative charts created to illustrate estimated Medigap costs:

FAQs

How much does Medigap cost in Delaware?

Delaware Medicare Supplement premiums will vary depending on several factors. The factors most impactful for rates are your age and the Plan letter you choose. Medigap premiums in Delaware range between $120 and $170.

What are Medigap premiums based on in Delaware?

There are three different types of Medigap plan pricing methods in Delaware:

- Community-rated, where residents get charged the same amount regardless of age

- Issue-age-rated, where premiums get based upon the period you buy your policy.

- Attained-age-rated premiums revolve around the age you “attained” your policy, meaning premiums go up as you age.

What factors may affect a Medicare beneficiary’s Medigap policy premium in Delaware?

Delaware prices Medigap premiums according to various factors. Age, location, gender, tobacco use, etc., are all factors that can affect premiums. When you bought your Medigap policy also impacts your premiums.

Do Medigap premiums go up every year in Delaware?

Medigap premiums generally increase yearly in Delaware, usually occurring on the anniversary of your policy. Occasionally, Medigap premiums also don’t change each year. Sometimes Medigap premiums even decrease.

However, these occurrences don’t happen often, so expect premiums to increase yearly.

Is there a cap on Medigap premiums in Delaware?

Yes, some Medigap plans feature premium caps in Delaware. For example, Plan L and K feature premium gaps of $3,310 and $6,620.

Known as “out-of-pocket limits,” these limits get determined by 1882(w)(2) of the Social Security Act.

What is not covered by Medigap in Delaware?

While Medigap policies in Delaware go a long way in covering gaps left behind by Original Medicare, some areas aren’t covered.

For example, your Medigap plan won’t cover prescriptions, hearing aids, vision care, dental care, eyeglasses, and private nursing care.

How to sign up for a Medicare Supplement plan in Delaware

Finding the right Medigap plan is challenging. Each plan comes with its unique benefits and monthly premiums, and deductibles.

To find the right plan that makes the most sense for you, your budget, and your medical needs, our licensed insurance agents team can help. They work with all carriers and can pair you with the right plan. Our team also compares different plans to find the best fit for you while providing a free service.

Call us today or fill out our online rate form to get the best rates for Delaware Medicare Supplement plans!