South Dakota Medicare Supplement plans, also known as Medigap plans, are insurance policies that you may add to Medicare for additional supplemental coverage. The federal government standardizes these policies, meaning each plan offers the same benefits.

Below, we will discuss some of the top providers for Medigap Plans in South Dakota and the accompanying rates so you can find what’s best for you.

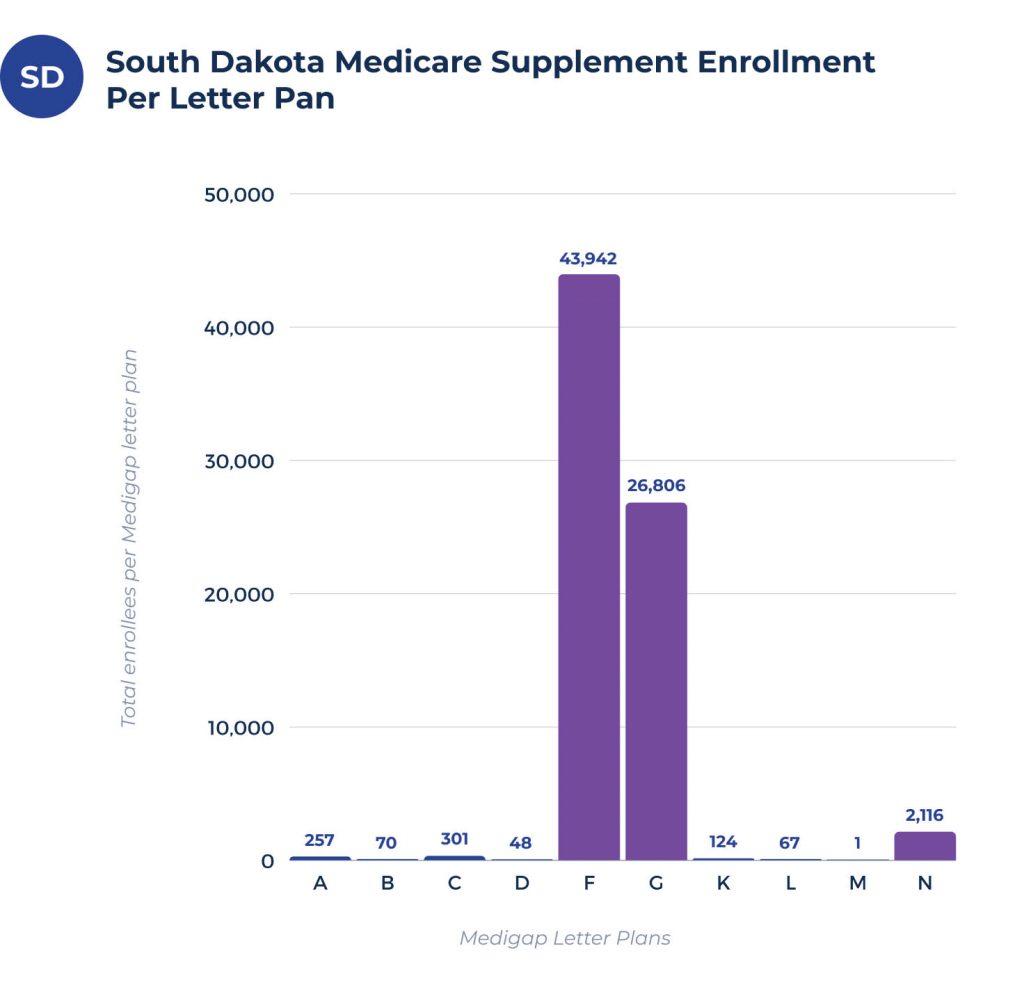

South Dakota Medicare Supplement Enrollment Per Letter Plan

Out of the 13,990,820 beneficiaries enrolled in Medigap coverage in the United States, 72,306 received coverage from South Dakota.

In the state, 48.4% of Medicare Fee-For-Service Beneficiaries added Medigap coverage to their plans.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 309 | 91 | 406 | 40 | 96 | 50,506 | 17,348 | 8 | 53 | 527 |

What are the Most Popular Medigap Plans in South Dakota?

The chart above shows that the most popular South Dakota Medigap plan is Medicare Supplement Plan G, which offers low premiums and comprehensive coverage. In South Dakota, 50,506 beneficiaries take advantage of this plan.

The next most common plan in South Dakota is Medicare Supplement Plan K, offering a lower monthly payment with increased deductible costs. This plan is also a crowd favorite, with 17,348 beneficiaries enrolled in South Dakota.

Many enrollees also choose Medicare Supplement Plan N, which requires you to pay out-of-pocket for excess charges, copayments, and ER visits, though your premium isn’t too high. There are 527 South Dakota citizens enrolled in this plan.

Medigap Plan Coverage Chart for South Dakota

The benefits listed in the chart below remain the same from state to state. South Dakota residents may use this information to understand their coverage for each plan. Consider your regular medical costs and what you need to cover the most to find the right option for you.

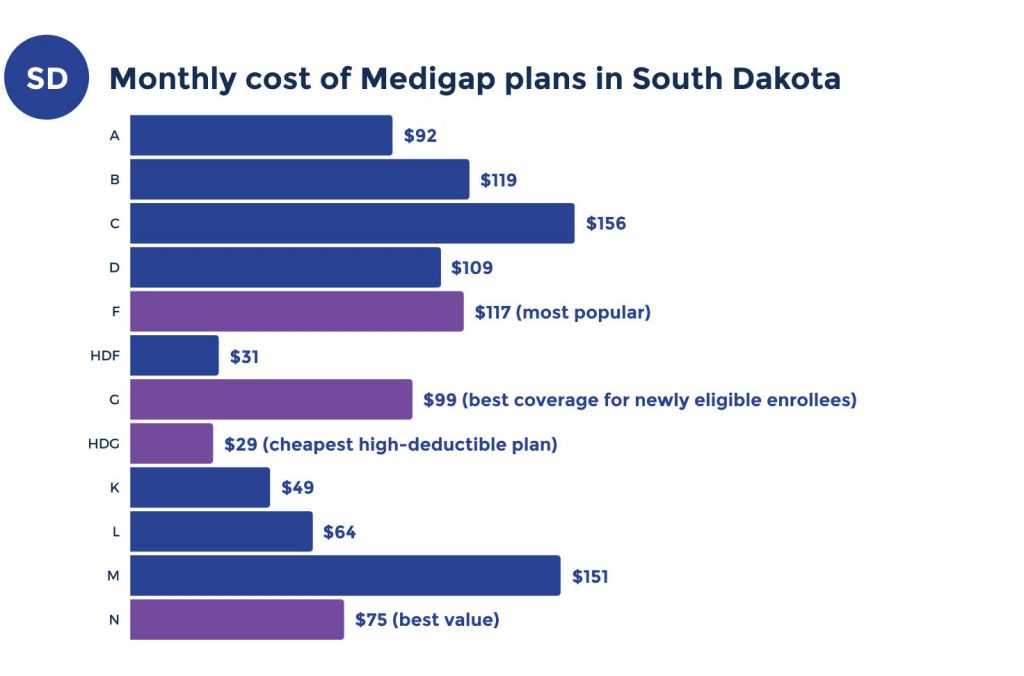

Medicare Supplement Plans Costs in South Dakota

Many factors impact your Medigap premium, which is how much you pay monthly. Your location, gender, age, tobacco usage, household discounts, payment method, rate increase history, enrollment date, and locked rate all impact your quoted price.

Plans always offer standardized coverage, though the cost varies depending on who you’re.

What’s the average cost for a Medicare Supplement Plan in South Dakota?

Medicare Supplement premiums in South Dakota vary because of several factors. The monthly premiums can range betweem $70 to $145.

Inexpensive Premium Per Medigap Letter Plan in South Dakota

The table below depicts quoted prices for a 65-year-old female living in South Dakota. These prices fall on the inexpensive end, so you shouldn’t expect premiums much lower than this.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $91 | $118 | $145 | $109 | $111 | $92 | $48 | $63 | $109 | $73 |

Highest Premium Per Medigap Letter Plan in South Dakota

A 70-year-old male living in South Dakota should expect the following quoted premiums to be some of the most expensive options. As you can see, some plans cost as much as $437 per month.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $334 | $336 | $434 | $352 | $437 | $415 | $172 | $257 | $244 | $303 |

Top Medicare Supplement Plan Carriers in South Dakota

The information below displays quoted costs for a 65-year-old female in South Dakota. Sibi USA offers some of the cheapest quotes across Plan F, Plan G, and Plan N, while Nassau reaches the more expensive end.

| CARRIERS | PLAN F | G | N |

| Slbi USA | $111 | $101 | $73 |

| American Financial | $117 | $101 | $77 |

| Nassau | $124 | $119 | $86 |

| United States Fire | $126 | $102 | $78 |

| Physicians Life | $130 | $111 | N/A |

Estimated Medicare Supplement Premiums for South Dakota Cities

The accompanying charts linked below provide the estimated premiums for each type of Medicare Supplement plan for the cities listed:

FAQs

What is Medigap in South Dakota?

Original Medicare helps you pay for healthcare costs and supplies, though it doesn’t cover everything. South Dakota Medicare Supplement, or Medigap, is private insurance that can cover some of the costs that Original Medicare doesn’t. Medigap plans help you pay copays, deductibles, coinsurance, and more.

Specific Medigap plans extend beyond Original Medicare’s reach by offering options like foreign travel coverage.

Does Medigap in South Dakota vary from the plans in other states?

Yes, Medigap in South Dakota differs from the programs in other states. While the federal government standardizes the coverage amounts and limitations, private insurers change rates depending on where you live.

South Dakota residents won’t receive the same premium rates as enrollees in neighboring states.

Do Medigap premiums increase with age in South Dakota?

Medigap premiums increase with age in South Dakota if you don’t purchase until you’re older. The younger you’re when you enroll, the cheaper rates you’ll receive. Your rate won’t increase as you age after you’ve purchased.

Remember that your premium could still fluctuate from other factors like inflation.

Does Medigap cover all out-of-pocket costs in South Dakota?

Out-of-pocket costs refer to any healthcare bills your Original Medicare doesn’t cover. Medigap doesn’t pay for all out-of-pocket expenses in South Dakota.

Medicare Part C and Part D include out-of-pocket maximums, meaning you will never have to spend more than the determined amount. Medicare Part A and Part B don’t include any maximums.

Does Medicare Supplement cover drugs in South Dakota?

Medicare Supplement plans included prescription drug costs up until 2006. Today, Medigap policies in South Dakota can’t cover the costs of your prescription medications.

You can sign up for the Medicare Prescription Drug Plan Part D if you need prescription coverage. Some insurers will require you to pay two premiums for the separate Medigap and Medicare drug policies.

How to Sign Up for Medicare Supplement Plan in South Dakota

Once you’re ready to sign up for a South Dakota Medicare Supplement plan, we’re prepared to help at Medigap.com. We want to help you get right coverage with easy, convenient, and effective quotes and recommendations. We work with all of the major carriers and will compare plans to find the best one for you.

Enjoy zero obligations and costs when you receive quotes from our Medigap.com service. Compare your options in just a few minutes and speak with a live representative for personalized help.

Call our experienced team for free today at Medigap.com or fill out our convenient online rate form to get rates now!