When you’re first eligible for Medicare, it’s crucial to verify and do a few things to ensure you don’t receive a penalty for late enrollment into different parts of Medicare.

How Medicare Late Enrollment Penalties Work

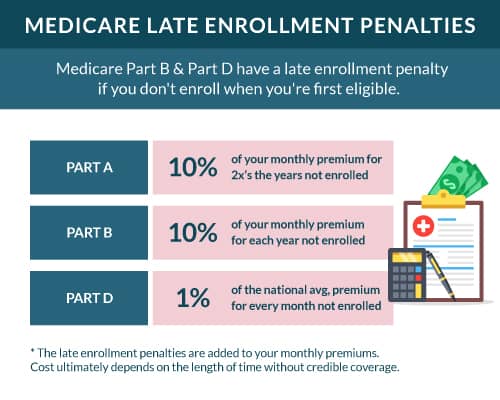

Different parts of Medicare come with late enrollment penalties. These penalties fall under Part A & Part B. There’s also a penalty if you don’t take Medicare Part D when you first reach eligibility.

Why is There a Medicare Late Enrollment Penalty?

Medicare created late enrollment penalties to encourage beneficiaries to enroll in health coverage insurance during the Initial Enrollment Period. To fund Medicare, the program needs eligible beneficiaries to enroll when they’re first eligible.

Part A Late Enrollment Penalty

For most Americans, this will not apply as they qualify for Medicare Part A for a $0 premium due to working for at least ten years for themselves or their spouse.

Those not in this situation must enroll in Part A when first eligible unless they have creditable health coverage. If they don’t have creditable coverage and don’t start their Part A, they have a Medicare Late-Enrollment-Penalty.

How Much is the Part A Late Enrollment Penalty?

If you don’t take Part A when first eligible and don’t have creditable coverage, you’ll be subject to a 10% penalty on your Part A premium for twice as long as you did not have coverage.

For example, if you don’t take your Part A for four years, you’ll pay the increased monthly premium for the next eight years. If considered low-income, you may qualify for programs paying the Part A premium.

Part B Late Enrollment Penalty

The Medicare Part B penalty applies to beneficiaries that don’t take their Medicare Part B when first eligible and did not have creditable coverage.

Medicare has a premium for Part B unless you qualify for a Medicare Savings Program that will pay it.

The Part B premium is calculated based on how many years you delayed enrolling into Part B and didn’t have another form of creditable coverage.

How Much is the Part B Late Enrollment Penalty?

The Part B penalty is 10% of the Part B premium for every consecutive 12-month period you were eligible for but did not elect coverage.

For example, if you went four years, 48 months, without taking Part B once you were eligible and did not have creditable coverage, you’ll have a 40% penalty on top of the standard Part B premium.

The current Part B premium is $174.70. You would pay an additional $80 monthly for the rest of your life.

Part D Late Enrollment Penalty

Like the Part A and Part B penalties, the prescription drug coverage penalty revolves around not taking the coverage when first eligible. The drug coverage penalty is also called the Part D penalty. Qualifying for the low-income subsidy program (Extra Help) will waive the penalty.

How Much is the Part D Late Enrollment Penalty?

You’ll accrue a 1% penalty of the average monthly drug plan cost each month you don’t enroll or have creditable prescription drug coverage.

Let’s assume you went four years without taking drug coverage. You’ll receive a 1% penalty that compounds monthly. You would have a 48% penalty. The current average Part D premium is a little more than $55.50. Your Part D penalty would be about $14 a month.

No matter which drug health plan you were to enroll in, you would pay an additional $14 a month on top of your plan’s premium for the rest of your life.

How to Avoid Medicare Late-Enrollment-Penalties

Avoiding these penalties is relatively easy. As long as you worked for ten years, or your spouse has, you get Part A premium free. Whether you need it or not, it makes sense to enroll anyway.

If you’re working, contact your benefits administrator for your group coverage. Ask if the group coverage is creditable coverage under Medicare. If so, you don’t need to enroll. However, you can still enroll in Part A since it’s premium-free.

When your group coverage ends, you get a Special Enrollment Period to enroll in Medicare. The group coverage is not considered creditable if your employer has less than 20 employees. There is also an Open Enrollment Period.

If you have VA coverage, enroll in Part B when you’re first eligible. VA benefits are not considered creditable coverage under Medicare Part B. However, VA benefits are considered creditable under a Part D plan.

How Can I Eliminate Medicare Late Enrollment Penalties?

There are a few ways to try and get the penalty waived. You can contact Social Security to appeal the late enrollment penalty. You can apply for the Extra Help or the Medicare Savings Program if you have a low income.

You could be eligible for a Medicare Savings Program if you’re dual-eligible for Medicare & Medicaid health care. These programs will waive or pay for any penalties you may have incurred.

Your penalties will also disappear if you accrued them when you were under 65 and on Medicare due to collecting SSDI for 24 months. When you turn 65, your penalties will reset.

FAQs

What happens if I miss the Medicare enrollment deadline?

You could incur a late enrollment penalty if you miss the enrollment deadline. Then you might have to wait until a Special or General Enrollment Period to then enter Medicare.

Does a Part A penalty exist for late enrollment?

For most people, the answer is Part A doesn’t see a penalty since it’s already free of a premium. However, this isn’t true for everyone.

How long is a member responsible for a late enrollment penalty?

The base beneficiary premium increase with late enrollment stays with the Medicare recipient for however many years they have the coverage.

How do I avoid the Medicare Part B penalty?

You can refuse to enroll in Part B if you have creditable coverage. But to ensure you avoid it, signing up for it during the Initial Enrollment Period is the only foolproof way.

What are the penalties for late enrollment in Medicare Part B?

You receive a 10 percent premium penalty increase for Medicare Part B for every full 12-month period you remain unenrolled.

What can I do to avoid the late enrollment penalty?

Enrolling during your Initial Enrollment Period when you first become eligible for Medicare is the best way to avoid any late enrollment penalties.

Can I get a penalty for Medicare Advantage?

Since a Medicare Advantage plan is optional after you’ve already enrolled in Original Medicare, it’s impossible to have a penalty for not enrolling in one.

How to Get Help with Medicare Late Enrollment Penalties

Talk to the Medicare experts today if you don’t want to get hit with costly penalties. Our licensed insurance agents have complete knowledge to help beneficiaries avoid late enrollment penalties.

Our agents can help you with your Medicare Advantage, Medigap, or Part D prescription drug plans. These Medicare supplements can mean the difference between comprehensive health insurance and receiving large, unexpected medical bills.

Give us a call today. Or fill out our convenient online rate form to be connected with the best rates in your area.