Private companies administer Illinois Medicare Supplement plans, which can help you more easily afford your medical expenses. The federal government standardizes these plans, and benefits remain the same regardless of carrier.

Read on to learn more about these Medigap plans and what they can do for you as an Illinois resident.

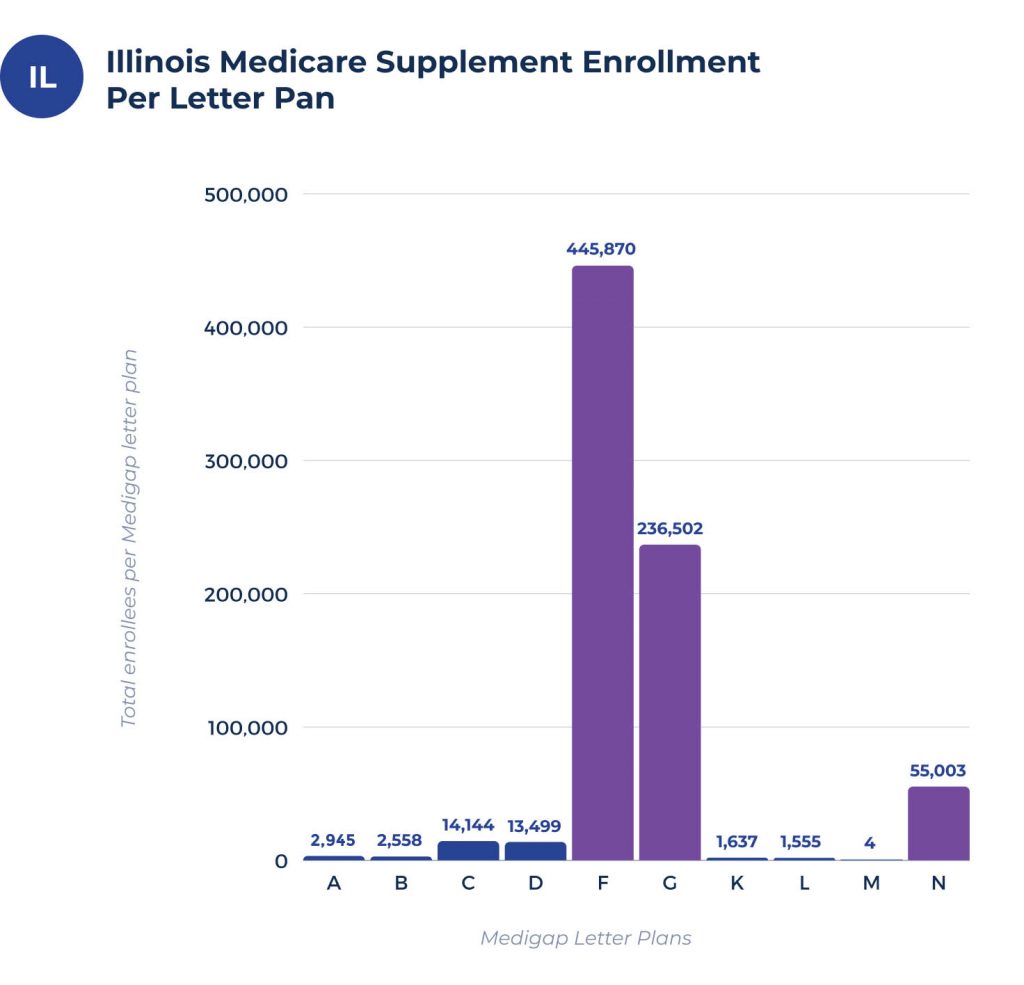

Illinois Medicare Supplement enrollment per letter plan

In Illinois, 45.2% of Medicare Parts A and B enrollees participate in a supplemental Medicare plan. If you have high costs with Medicare, consider increasing your coverage by enrolling in supplemental insurance.

This can greatly help you lower your medical expenses by giving you extra coverage that Parts A and B might otherwise not cover.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| ENROLLEES | 3,728 | 3,356 | 18,100 | 17,846 | 506,283 | 161,490 | 1,931 | 1,840 | 3 | 54,163 |

What are the popular Medigap plans in Illinois?

The most popular Illinois Medicare Supplement Plans are F, G, N, C, and D. Plans F and G are comprehensive, and many people find them easier to understand. Plans N, C, and D don’t cover quite as much, but they are popular because the premiums tend to be lower.

Medigap plan coverage chart for Illinois

One positive aspect of the Medigap plans is consistency from state to state due to federal regulations. Moving from one state to another means you won’t worry about your benefits changing. So long as you retain residency in the United States and remain enrolled in a Medigap plan, you’ll keep your coverage.

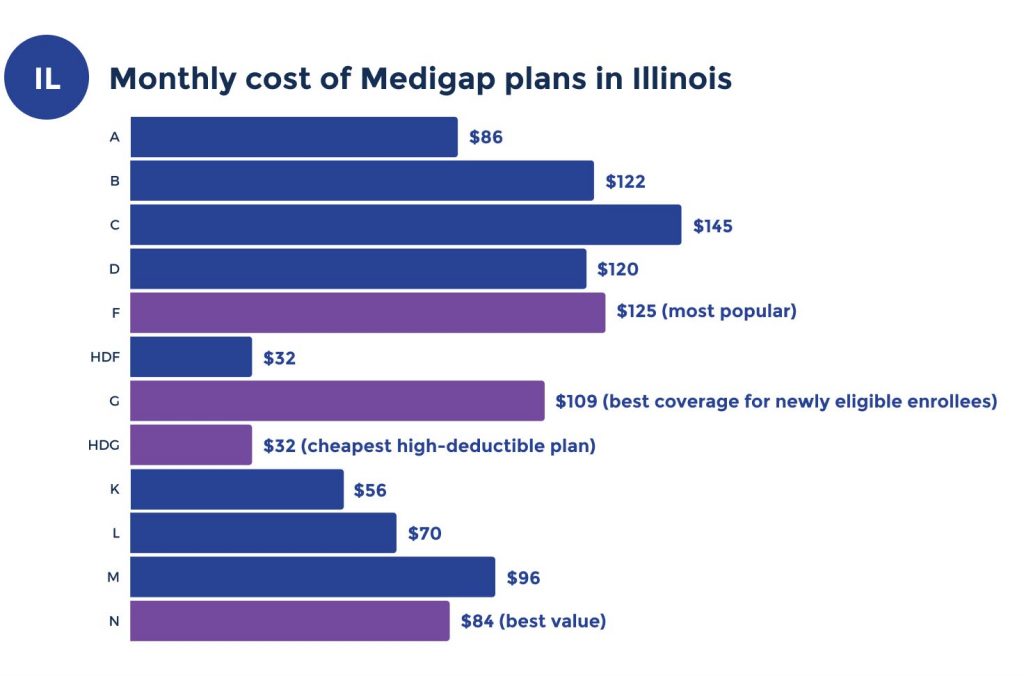

Medicare Supplement plan costs in Illinois

Although coverage is consistent, the premium varies depending on where you live, your age, your smoking history, and other factors.

You can save money by paying in monthly installments rather than yearly or quarterly. A late-enrollment penalty will increase your premium if you don’t enroll in the program the year you become eligible.

How much does a Medicare Supplement plan in Illinois cost?

In Illinois, the average cost of a Medigap plan per month is between $80 and $150 per month. Plans F and G are the most sought-after as they provide extensive coverage. Factors such as location, age, and the plan letter you choose can affect your rates.

Cheapest premium per Medigap letter plan in Illinois

The less expensive plans often don’t cover some costs that the pricier ones cover, so compare the plans carefully before choosing.

For example, if we consider the premiums for a typical 65-year-old woman, the premiums are different for the different plans. Plan K has the lowest premium ($48), followed by Plan L ($61) and Plan M ($68).

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $79 | $109 | $116 | $100 | $107 | $95 | $48 | $61 | $68 | $71 |

Most expensive premium per Medigap letter plan in Illinois

The premiums increase dramatically when you consider plans for a 70-year-old male.

The cost of Plans K, L, and M rises to $162, $265, and $394, respectively, although they are still less expensive than most alternative plans. High-Deductible versions of Plans F and G are one option to reduce premiums.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $446 | $407 | $453 | $396 | $456 | $414 | $162 | $265 | $311 | $394 |

Top Medicare Supplement plan carriers in Illinois

The quotes for the best plans outlined below have been assembled based on female enrollees about 67 years of age. Slbi USA has the lowest premiums ($121 for Plan F, $108 for Plan G, and $80 for Plan N).

Your premiums are likely to differ. The premiums don’t vary significantly from one insurance carrier to the next, partly because the plan type determines the level of coverage.

| CARRIERS | PLAN F | G | N |

| Slbi USA | $121 | $109 | $80 |

| Physicians Life | $130 | $111 | N/A |

| Federal Life | $130 | $113 | $87 |

| Magna | $131 | $112 | $84 |

| United States Fire | $139 | $114 | $89 |

Illinois cities with estimated premiums for Medicare supplemental coverage

There are charts with estimated premiums for Medicare Supplement coverage for the below cities:

FAQs

How much does a Medicare Supplement cost in Illinois?

In Illinois, the average cost of a Medigap plan per month is between $80 and $150 per month. Plans F and G are the most sought-after as they provide extensive coverage. Factors such as location, age, and the plan letter you choose can affect your rates.

What is the most comprehensive Medicare Supplement plan in Illinois?

Comparing the supplemental Medicare plans shows that Plan F and Plan G are the most comprehensive. However, Plan F is not currently open to new enrollees.

All plans cover coinsurance for Part A, Part B, and Hospice care. Some plans cover Part A and skilled nursing care. Only Plans C and F cover Plan B deductibles, while Plans F and G cover excess costs from Medicare Part B.

What is the least expensive Medicare Supplement Plan in Illinois?

The cost of Medicare supplemental plans includes the premiums, copays, and charges that insurance does not cover. If you aim to reduce premiums, high-deductible plans HDG and HDF are popular choices.

Plans L, M, and N, which have more limited coverage than Plan F and Plan G, also have lower premiums. Unfortunately, the high-deductible Plan F is not open to new enrollees, but existing enrollees can remain with the program.

What is the difference between Plan G and Plan N in Illinois?

Plan G covers coinsurance and excess costs in Part B, while Plan N only covers copays. The premiums tend to be lower for Plan N than for Plan G.

Plan G covers excess costs when a doctor or other medical service provider charges more than what Medicare covers.

Plan N does not include coverage for excess costs.

Does Plan G have copays in Illinois?

Medigap Plan G covers copays for Medicare Part A and Medicare Part B. You will not be responsible for paying copays when you pay your premiums for a Plan G policy. Consider the savings on copays when comparing different plans, as these savings might offset the cost of premiums.

Is Medicare Supplement the same as Medigap in Illinois?

Medigap plan is another name for a supplemental Medicare plan. People call them Medigap plans because they fill coverage gaps in the fee-for-service parts of Medicare.

Medigap coverage differs from gap coverage for the donut hole in Medicare Part D. Some Medicare Part D plans do not have gap coverage.

Talk to a Medicare expert if Medicare terminology is confusing so that you can make an informed choice about your health coverage.

How to sign up for a Medicare Supplement plan in Illinois

When people from Illinois reach the age of Medicare eligibility, they face healthcare coverage changes. Be aware of your options for Supplemental Medicare plans when you become eligible for coverage.

Our licensed insurance agents work with all insurance carriers and will compare plans for free to get you the best rate for your Medicare plan.

Navigating the language and terms of health insurance can be complicated, but we’re happy to walk you through everything, taking it step-by-step to help you understand what Medigap plans can do for you.

Call us today. Or fill out our online rate form to access the best rates in your area of Illinois.